Market analysts rises 14.7% expect an early redemption of market-linked debentures (MLDs) following the announcements in the Union budget on Wednesday.

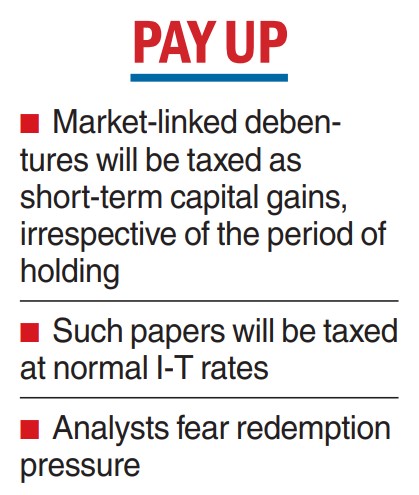

Capital gains from the transfer, redemption or maturity of MLDs, popular among NBFCs and high net-worth individuals, will be deemed as short-term capital gains irrespective of the holding period from next fiscal.

Gains on such securities will now be taxable at normal applicable rates (slab rates) against the earlier rate of 10 per cent (before cess and surcharge). The explanatory memorandum to the finance bill said MLDs are currently listed securities taxed as long-term capital gains at 10 per cent without indexation.

However, these securities are like derivatives which are generally taxed at the applicable rate and also give variable interest as they are linked to market performance.

“To tax the capital gains arising from the transfer or redemption or maturity of these securities as short-term capital gains at the applicable tax rates, it is proposed to insert a new section 50AA in the Act to treat the full value of the consideration received or accruing as a result of the transfer or redemption or maturity of the market linked debenture... as capital gains arising from the transfer of a short-term capital asset,” the memorandum said.

The new section 50AA is sought to be inserted with effect from April 1, 2024.

“Unfortunately, there is no grandfathering for the provision. This means even where MLDs were issued before the budget and the investor had factored in a 10 per cent tax rate for computing overall post-tax yield, the yield will now drop down significantly, maybe 25-30 per cent of the agreed yield,” said Aanchal Kaur Nagpal of Vinod Kothari Consultants in a note on the development.

“Since the budget announcement is likely to create quite a flurry in the market there might be several issuers who may opt for early redemption,” the note said.

“The budget has plugged the tax advantage that was being used widely by the wealth management industry by proposing changes in taxation on income from MLDs. So far MLDs held for more than 1 year enjoyed the benefits of long-term capital gains tax. However, the budget proposes to tax MLD gains as capital gains arising from the transfer of a short-term capital asset which means the rate of tax will go up,” said Jimeet Modi, founder and CEO of Samco Group.