Expensive valuations may see India’s stock indices remain rangebound in 2023, top brokerages said.

The benchmarks has so far risen over 6 per cent this year — a volatile period marked by Russia’s invasion of Ukraine, rising inflation and aggressive monetary tightening by various central banks. Markets benefited from strong domestic inflows and a resilient economy with foreign portfolio investors (FPIs) resuming buying from July.

While the Sensex and Nifty hit record highs recently and have outperformed their global peers, analysts feel the rich valuations could turn spoilsport in 2023 leading to the benchmark indices eking out marginal gains. The analysts also warned of major headwinds such as the US Federal Reserve continuing with its rate hikes throughout the year, recession in some of the major global economies and volatility in FPI flows. They cautioned that export-oriented sectors such as information technology could underperform next year.

Jefferies said in a note that with India among the best performing markets globally in 2022 and hitting new highs recently, steep valuations imply that Nifty will be range-bound at 17000-19500.

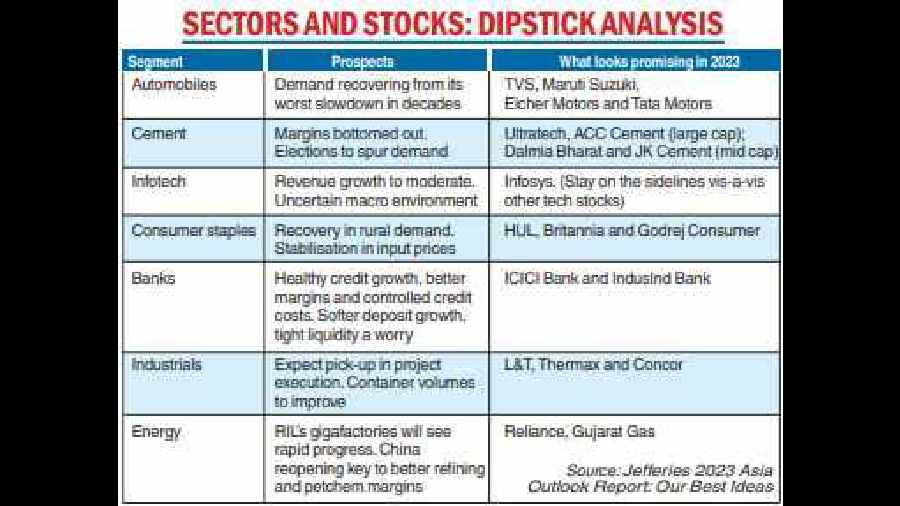

The brokerage feels corrections should offer a buying opportunity, giving a thumbsup to sectors such as large banks, auto, consumer staples, property and select capital goods.

Similarly, BNP Paribas said in a note that it is downgrading India to neutral from overweight on account of rich valuations.

Its analysts pointed out that presently, the Sensex is trading over three times its one-year forward price-tobook value which is equivalent to its five-year average priceto-book value. The brokerage added that the Sensex valuation is the highest among the emerging market peers who are trading 0.9-1.7 times their one-year forward price-tobook value.

One of the key disappointing spots is expected to be the IT pack that has underperformed even this year, dragged by concerns that its earnings would moderate on account of the downturn in the global economy.

In 2022, the S&P BSE IT index is down 25 per cent. On the other hand, banking, power (BSE Power index up 30 per cent), auto (up 20 per cent) and FMCG (up 21 per cent) are some of the sectors that have given better returns than the Sensex.

In its Asia Outlook 2023, Jefferies projected that revenue growth for Indian IT services firms is likely to moderate 250 basis points to 7 per cent in 2023 and 2023-24 because of the tightening of client budgets, re-prioritisation of tech spend and delayed decision making amid an uncertain macro environment.

It added that the sector witnessed a sharp derating coupled with EPS (earning per share) downgrades in 2022 on the back of recessionary fears and inflationary pressures in the US and Europe.

"While revenue growth has been steady in 2022, and bookings have held up well till now, the weak macro environment is expected to drive uncertainty in demand outlook for 2023.”

“Management commentary has been worsening every quarter with more areas of weakness highlighted every passing quarter. Top clients across multiple verticals are highlighting weakness in their outlook, which does not bode well for IT demand growth in 2023,’’ the brokerage cautioned.