Two of India’s best known names in financial services are coming together to create a colossus that will better tap the rising demand for credit.

After years of speculation, the HDFC twins on Monday announced a merger that will see mortgage lender HDFC Ltd amalgamating with India’s largest private sector lender, HDFC Bank in a $40 billion deal.

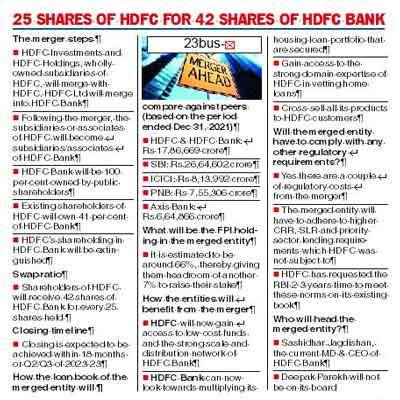

The merger is expected to be completed by the second quarter or third quarter of 2023-24.

Under the swap arrangement, 25 HDFC shares will be exchanged for 42 shares of HDFC Bank.

“The value of HDFC Ltd is $60 billion. If you strip off the portion of their holding in us, it comes to $40 billion and that’s the value of the deal,” HDFC Bank CEO Sashidhar Jagdishan, who will head the combined company, told reporters at a press conference.

That would mark the largest banking sector M&A globally since April 2007, according to Refinitiv data.

Foreign ownership will account for 65-67 per cent of the merged company, giving foreign investors scope to buy up to a further 8 per cent.

The merger in the same family will create an entity with a loan book of over Rs 17.86 lakh crore and net worth of Rs 3.3 lakh crore.

Based on the closing prices of their shares on Monday, the joint market capitalisation stands at Rs 14.04 lakh crore, higher than second most valued company TCS, which has a market capitalisation of Rs 13.79 lakh crore. Reliance has the highest market value at Rs 18.01 lakh crore.

“This is a merger of equals. It’s a friendly merger. As the son grows older, he acquires the father’s business, that’s what happening here,’’ HDFC chairman Deepak Parekh said.

The merger has been talked about for several years but without action as the costs outweighed the benefits. HDFC remained an NBFC-HFC where Reserve Bank of India (RBI) rules were less stringent than commercial banks such as HDFC Bank.

The regulatory leeway or arbitrage available to non-banking finance companies has reduced particularly after the IL&FS and DHFL crisis, as the banking regulator tightened the rules and harmonised them with banks.

Parekh said over the last few years there have been certain regulatory changes for banks and NBFCs, which considerably reduced the barriers for a potential merger.

“The merger makes the combined entity strong enough to not only counter competition but make the mortgage offering even more competitive. We will be able to offer all the variations in the mortgage product which currently we are unable to offer as a housing finance company like the overdraft product. The funding challenges both in quantum and cost will be minimised by the combined entity,’’ Parekh said.

Parekh,77, will not be on the board because the upper age limit for non-executive directors including the chairman in a private sector bank is 75 years. The age limit for MD, CEO and whole-time director is 70 years.

The companies said HDFC Bank will be owned 100 per cent by public shareholders, with the existing shareholders of HDFC holding 41 per cent. HDFC and its two arms now hold around 25.80 per cent in the bank and the rest is with the public. The HDFC stake will be extinguished after the amalgamation.

HDFC’s surprise announcement was received positively by the markets with its share soaring 9.30 per cent on the BSE to end at Rs 2,678.90, while the HDFC Bank scrip gained almost 10 per cent to settle at Rs 1,656.45.

Two-times ICICI

S&P Global Ratings said the new entity will be twice the size of ICICI Bank.

“HDFC Bank’s larger balance sheet could enhance its wholesale lending opportunities,’’ S&P Global Ratings said.

(With inputs from Reuters)