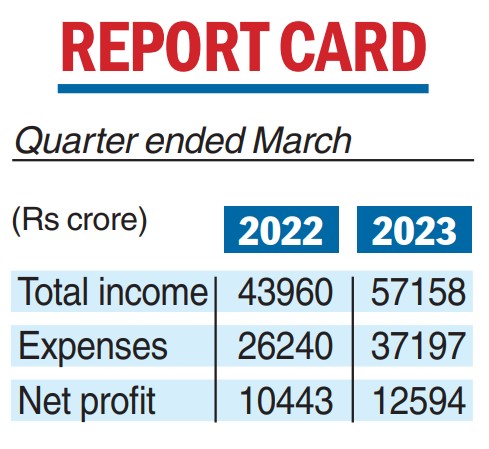

Largest private sector lender HDFC Bank on Saturday reported a 20.6 per cent jump in its consolidated net profit to Rs 12,594.5 crore for the March 2023 quarter, driven by a healthy core performance. For the entire fiscal, it reported a 20.9 per cent increase in the net profit at Rs 45,997.1 crore.

The city-based lender, which is in the middle of merging its mortgage lending parent HDFC, reported a 19.8 per cent growth in post-tax profit on a standalone basis at Rs 12,047.5 crore.

Its core net interest income rose 23.7 per cent to Rs 23,351.8 crore on the back of a 16.9 per cent jump in advances and the net interest margin being maintained at 4.1 per cent.

Other income increased to Rs 8,731.2 crore for the reporting quarter from Rs 7,637.1 crore in the year-ago period. All the components under this line showed an improvement, except trading and mark-to-market, where it reported losses of Rs 37.7 crore compared with a gain of Rs 47.6 crore in the year-ago period.

Amid the ‘war for deposits’ in the system, the lender has ducked the system-wide trend by reporting a 20.8 per cent growth in its base. Share of the low-cost current and savings account deposits stood at 44.4 per cent as of March 31, 2023.

Retail loans grew by 19.3 per cent, corporate and wholesale banking loans rose by a slower 12.6 per cent, while the nearly 30 per cent rise in commercial and rural banking advances, helping it report the overall loan growth number.

Retail and corporate advances are now evenly placed in the overall loan pie, having a 38 per cent share, while commercial and rural banking occupies the remaining 24 per cent.

From an asset quality perspective, the bank — which is highly regarded for its hold over such issues — reported an improvement, with the gross non-performing assets ratio improving to 1.12 per cent as of March 2023 against 1.17 per cent a year ago and 1.23 per cent at the end of the preceding December quarter.

The overall provisions were reduced to Rs 2,685.37 crore for the reporting quarter on a standalone basis against Rs 3,312.35 crore in the year-ago period and Rs 2,806.44 crore in the preceding quarter.

Its overall capital adequacy came at 19.3 per cent as of March 2023, up from 18.9 per cent in the year-ago period.

The bank’s overall number of branches stood at 7,821 as of March 31, of which 52 per cent were in areas it classifies as semi-urban and rural, while the rest are in metros and urban areas.

Its board of directors has recommended a dividend of Rs 19 per share for FY23 against Rs 15.5 per share in the year-ago period.