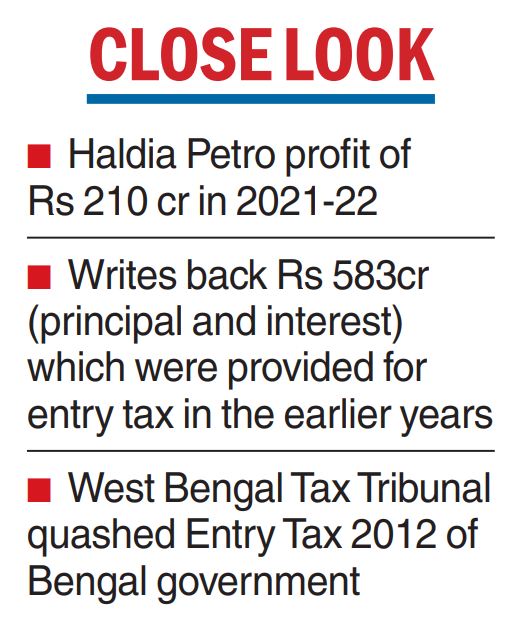

Haldia Petrochemicals Ltd, the flagship company of maverick Bengali entrepreneur Purnendu Chatterjee, posted a Rs 210.1 crore profit on a consolidated basis for the year ended March 31, after writing back provisions made on account of contentious Entry Tax, 2012 imposed by the Bengal government.

The company announced the results to the Bombay Stock Exchange for the first time in its history on Monday following the listing of HPL’s debt instrument on July 5.

On June 29, it had issued secured, redeemable non-convertible debentures (NCDs) of Rs 500 crore having average maturity of above five years on a private placement basis.

The board meeting of HPL took place on Monday to finalise the results which showed a 24 per cent jump in revenue from operations to Rs 12,723.6 crore in FY22 over Rs 10,258.8 crore in 2020-21.

The board also reappointed Subhasendu Chatterjee, elder brother of Purnendu, as a whole-time director for one more year from August 10, subject to the shareholders’ approval, BSE filing showed.

The company, one of the largest naphtha-based petrochemical plants in India, returned to profit in the last fiscal after reporting a loss of Rs 105.4 crore a year ago — aided by a Rs 583.3 crore exceptional gain during the October-December quarter of FY2022.

The writeback

The gain relates to a writeback of provisions made over the years by the company on account of an entry tax imposed by the Bengal government.

The decision followed an order of the West Bengal Taxation Tribunal (WBTT) on March 25, in which the retrospective amendments by the Bengal government were quashed.

The tribunal also declared as valid the order of the single judge bench of the Calcutta High Court declaring Entry Tax Act 2012 to be ultra vires of the Constitution.

The company, initially, had provided for the entry tax along with interest as applicable under the relevant act, but reviewed the status of the case periodically.

Based on such reviews, the WBTT judgment and recent legal opinions obtained in support of its reassessment, the company is of the view that there is a strong merit in the case in favour of the company. Haldia Petro does not foresee the possibility of any liability arising on the company or any cash outgo in this case, a note to the result declared.

HPL also informed the bourses on Monday that it has redeemed 1 per cent cumulative redeemable preference shares of Rs 10· each aggregating to Rs 271 crore on the maturity date of February 24 along with the current/arrear dividends thereon aggregating to Rs 10.5 crore. These shares were issued to state government entities decades back.