GVK Power & Infrastructure on Friday said its step-down subsidiary, GVK Airport Holdings, will acquire 12 crore shares of Mumbai International Airport (MIAL) for Rs 924 crore from ACSA Global.

After the completion of the deal to buy 10 per cent from ACSA, along with the earlier purchase of 13.5 per cent from Bidvest, GVK Group’s shareholding in MIAL will increase to 74 per cent from 50.5 per cent, the company said in a filing to the stock exchanges.

“GVK Airport Holdings Ltd has exercised it right, under the right of first refusal in terms of the shareholders’ agreement on April 4, 2006... to acquire 12 crore equity shares of MIAL, constituting 10 per cent of the total paid-up share capital of MIAL, from ACSA at the rate of Rs 77 per share,” it said.

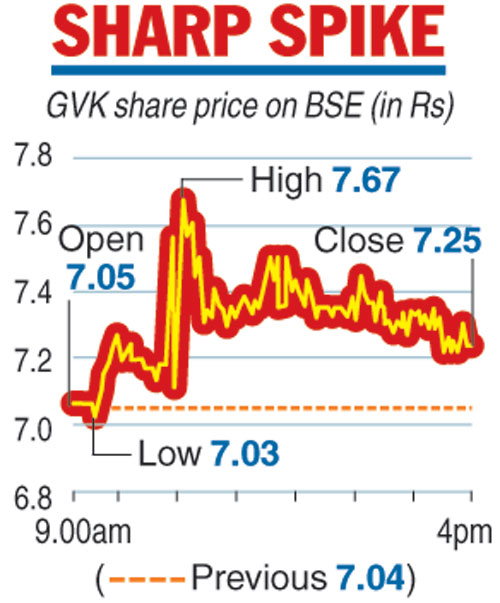

Shares of the company on Friday ended with gains of almost three per cent at Rs 7.25 on the BSE.

In January 2006, the GVK-led consortium, comprising Airports Company South Africa (ACSA) and Bidvest, won the bid to manage and operate GVK CSMIA.

Mumbai International Airport Pvt Ltd (GVK CSMIA) was formed by the GVK-led consortium (74 per cent) and the Airports Authority of India (26 per cent). In February, GVK Airport Holdings, a subsidiary of GVK Power, had acquired the 13.5 per cent stake held by Bidvest through its Mauritius subsidiary.

The Telegraph

GVK Power had acquired over 16 crore shares at Rs 77 per share.

During the third quarter ended December 31, 2018, the company had posted a net profit of Rs 16.15 crore compared with Rs 10.94 crore in the same period of the previous year.

The total revenue of the diversified company came in at Rs 22.66 crore against Rs 21.34 crore in the year-ago period.

The country’s airport sector was in the news recently when Adani Enterprises emerged as the highest bidder for six airports that the government had put up for privatisation with aggressive bids.

“With India pegged to emerge as the third-largest aviation market in the world by 2025, the government is eyeing five times expansion in airport capacity. This renders us bullish on the sector,” brokerage Edelweiss had said in a report.