Gujarat has become the first state to prepare a payout policy for its PSUs that draws heavily from a similar 2016 proposal of the Modi government at the Centre.

The state government has mandated minimum requirements for dividends, bonus shares, buybacks and share splits for its public sector undertakings.

State PSUs are required to cough up a minimum dividend of at least 30 per cent of profit after tax or 5 per cent of net worth, whichever is higher.

The PSUs with a net worth of at least Rs 2,000 crore and cash and bank balances of Rs 1,000 crore will be required to buy back its shares.

The PSUs have been told to issue bonus shares to their shareholders if their defined reserve and surplus is equal to or more than 10 times their paid-up equity share capital.

“It is expected that the new policy of compulsory dividends and bonus shares will add to the valuation of Gujarat State PSUs,” the state said in a resolution.

The PSUs are directed to split shares when the book value of shares exceeds 50 times its value, provided the existing face value of the share is more than Re 1.

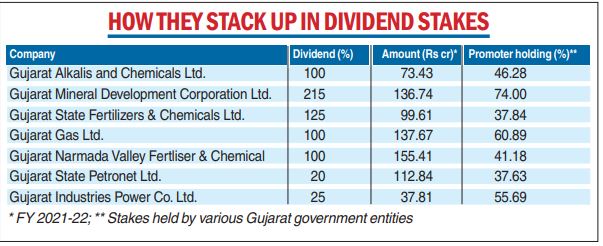

The seven listed PSUs in the state are all profit-making companies: Gujarat Alkalies and Chemicals, Gujarat Mineral Development Corp, Gujarat State Fertilisers and Chemicals Ltd, Gujarat Industries Power Co, Gujarat Gas Ltd, Gujarat Narmada Valley Fertilizers and Chemicals Ltd and Gujarat State Petronet Ltd. The PSUs are reportedly low dividend yield companies.

The shares of the seven companies jumped 7 per cent to 20 per cent on Wednesday’s trading sessions.

An analysis of the Gujarat budget by PRSIndia showed the total expenditure (excluding debt repayment) in 2023-24 is estimated at Rs 2.70 lakh crore, an increase of 18 per cent over the revised estimate of 2022-23.

The expenditure is proposed to be met through receipts (other than borrowings) of Rs 2.25 lakh crore, net borrowings of Rs 41,697 crore and receipts from the public account worth Rs 4,150 crore.

Total receipts for 2023-24 (other than borrowings) are expected to register an increase of 15 per cent over the revised estimate of 2022-23.

In 2023-24, Gujarat is estimated to have a revenue surplus of 0.4 per cent of gross state domestic product (GSDP) at Rs 9,038 crore, which is 35 per cent higher than the revised estimates for 2022-23 at Rs 6,694 crore.

The fiscal deficit for 2023-24 is estimated to be 1.8 per cent of GSDP (Rs 44,930 crore).

In 2022-23, fiscal deficit is expected to be 1.5 per cent of GSDP as per revised estimates, lower than the budget estimate of 1.6 per cent.

The revised estimates of net expenditure was 5.3 per cent higher than the budget estimate. This was balanced by a higher increase in net receipts.