The gross collection of goods and service tax (GST) soared to an all-time high of over Rs 1.42 lakh crore in March aided by the rationalization of rates and aggressive anti-evasion measures, the finance ministry said on Friday. The collection topped the earlier record of almost Rs 1.41 lakh crore in January.

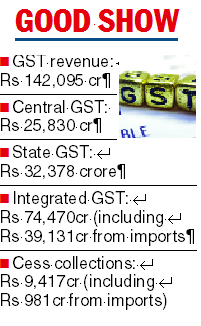

Out of the gross GST revenue of Rs 142,095 crore, central GST accounted for Rs 25,830 crore, state GST at Rs 32,378 crore, and integrated GST at Rs 74,470 crore (including Rs 39,131 crore collected from import of goods).

GST cess collections amounted to Rs 9,417 crore (including Rs 981 crore collected on import of goods).

“The improvement in revenue has been due to various rate rationalisation measures undertaken by the GST Council to correct the inverted duty structure,” the ministry said.

Measures on GST slab rate rationalisation are expected to be tabled at the next Council meeting.

Economic recovery and anti-evasion activities, particularly against fake billers, were also credited for the higher GST collections.

With the record collection, the Centre’s Goods and Services Tax (GST) mop-up has exceeded the revised budget target of Rs 5.7 trillion set for the previous fiscal ended March 31, 2022.

Experts, however, expressed some concern about the inter-state variation in GST collections.

“While GST collections rose by more than 15 per cent for Punjab, Haryana, Odisha, Maharashtra and Andhra Pradesh in March 2022, states like West Bengal. Jharkhand, Chhattisgarh, Madhya Pradesh, Tamil Nadu, Telangana, Rajasthan and Uttar Pradesh reported growth of less than 10 per cent.

“This suggests inter-state variation in consumption and investment growth and provides more support to state’s demand on continuation of GST compensation beyond five years,” said Devendra Kumar Pant, chief economist at India Ratings & Research.

The average monthly gross GST collection for the last quarter of FY2021-22 has been Rs 1.38 lakh crore against the average monthly collection of Rs 1.10 lakh crore, Rs 1.15 lakh crore and Rs 1.30 lakh crore in the first, second and third quarters, respectively.

The government has also dipped into the IGST corpus to top up the CGST pool by Rs 29,816 crore and the SGST trove by Rs 25,032 crore as part of what the government terms a “regular settlement”.

In addition, Centre has also settled Rs 20,000 crore of IGST on an ad-hoc basis in the ratio of 50:50 between Centre and states/UTs in March.

The total revenue of Centre and the states in the month of March 2022 after regular and ad-hoc settlements is Rs 65,646 crore for CGST and Rs 67,410 crore for the SGST.