The Goods and Services Tax Council met on Friday after a gap of almost seven months — and was immediately riven by dissent as the Centre and the Opposition-ruled states failed to reach an agreement on the contentious issue of fixing a zero rate of tax on all Covid-related products.

The Centre refused to relent, arguing that the tax waiver issue was devilishly complicated since it would have to cover a barrel-load of items across the value chain to be really effective, ensuring that no manufacturer was denied an input tax credit just because some product was let out of the ambit of the tax break.

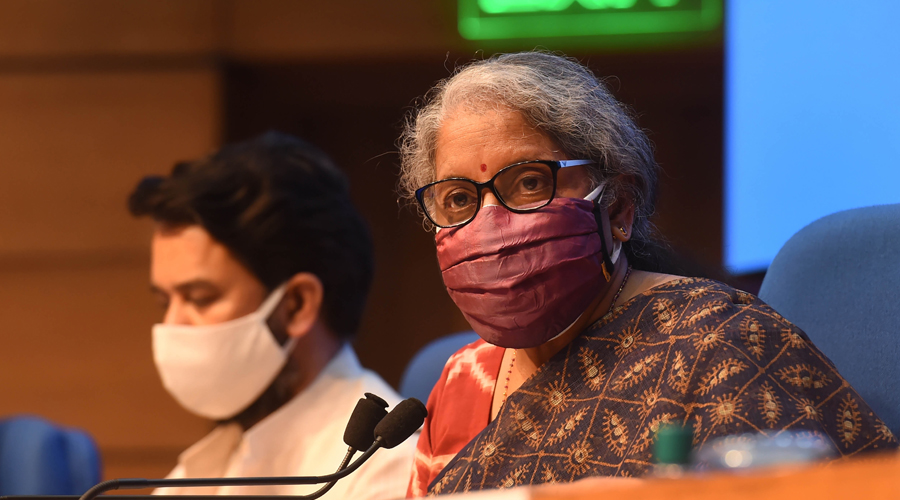

Finance minister Nirmala Sitharaman told reporters after a day-long video conference with state finance ministers that the whole complex exercise would be rendered meaningless unless there was some way to ensure that the benefit of the tax waiver flowed to the patient struggling to pay off humongous hospital bills.

At the end of the fractious meeting, the GST Council agreed to form a group of ministers that would examine the issue in greater detail before submitting a report on June 8. The group will decide on any new rates, exemptions and further cuts in levies on specified items.

Several Opposition-ruled states slammed the Centre later for showing less compassion for the people who are battling the pandemic by quibbling over end-user benefits.

“There were protracted discussions with varying viewpoints. So, I announced the formation of a GoM which will submit its report by June 8. If tax cuts need to be given we will do it,” she said, adding that efforts would be made to ensure that intermediaries did not corner the benefits leaving the patients high and dry.

The GoM was set up after hours of discussions failed to break the stalemate. The composition of the GoM will be decided on Saturday.

Several Opposition-ruled states, including Punjab, pressed for complete GST exemption on vaccines, oxygen concentrators, pulse oximeters, Covid testing kits and ventilators.

The GST Council’s fitment committee, which draws up rate revision proposals, wants to keep the rates on Covid vaccines unchanged. However, Bengal and Punjab have reiterated their demand for lowering duty on all Covid relief materials.

Union revenue secretary Tarun Bajaj said a GST rate cut on Covid products could be extended to private players like hospitals if there was a mechanism to ensure that they passed on the benefit to their patients.

He added that a similar question was raised on how the benefit of a GST rate cut on ventilators — which are only bought by hospitals — could be actually passed on to the patients.

The demand for a tax waiver on Covid products was first raised by Bengal chief minister Mamata Banerjee. Sitharaman said a 5 per cent GST rate on Covid vaccines would actually benefit both the manufacturer as well as the citizen. If the duty was exempted, vaccine manufacturers would not be able to offset their input taxes and would then try to pass on the cost to the consumer by raising prices.

Abhishek Jain, tax partner, EY, said: “Businesses may be slightly disappointed that they now have to wait till June 8 for a final decision on the additional GST exemptions for Covid relief activities.”

The GST Council decided to exempt the levy of IGST on import of Amphotericin-B, which is used for the treatment of black fungus.

The council decided to exempt from integrated GST Covid-related items which are imported on payment basis but donated to the government or given to a relief agency certified by the state authorities. The tax exemption will continue till August 31.

These items include medical oxygen, concentrators, certain diagnostic markers test kits and Covid-19 vaccines. Earlier, the Centre had exempted items donated by persons or overseas entities from IGST. That exemption has been extended to August 31 as well.

An amnesty scheme has been devised to reduce the payment of late fees by small taxpayers which reduce the compliance burden. The filing of annual returns will continue to be optional for small taxpayers for fiscal year 2020-21.

The GST Council said it will make appropriate changes to clarify that land owner promoters can utilise credit of GST that developers charge them for the apartments they build. The land promoter subsequently sells these apartments on which GST is paid. The developer promoter shall be allowed to pay GST relating to such apartments any time before or at the time of issuance of completion certificate.