GST collections in May crossed the Rs 1.5 trillion mark for the third consecutive month but fell short of the record sum of Rs 1.87 lakh crore collected last month.

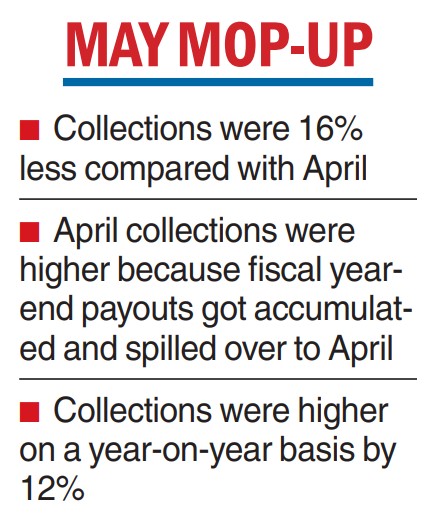

Data released by the government on Thursday showed the collections at Rs 1,57,090 crore in May. However, on a year-on-year basis, it showed a rise of 12 per cent over Rs 1,50,885 crore on May 2022.

Analysts attribute the sequential drop of 16 per cent to the fact the year-end closing activities relating to March got accumulated and spilled over to April resulting in higher collections.

Central GST collections stood at Rs 28,411 crore in May, state GST Rs 35,828 crore and intra-state GST, Rs 81,363 crore, including Rs 41,772 crore collected on the import of goods.

The government collected Rs 11,489 crore as cess, including Rs 1,057 crore from imports.

The Centre said it has settled Rs 35,369 crore to CGST and Rs 29,769 crore to SGST from IGST. The total revenue of the Centre and the States in May 2023 after the regular settlement is Rs 63,780 crore for CGST and Rs 65,597 crore for SGST, the statement said.

GST collections in March stood at Rs 1.60 lakh crore.

KPMG in India National Head (Indirect Taxes) Abhishek Jain said that the GST collection matches with the government budget estimates for this fiscal. “With extensive department GST audits lined up before September 2023, these figures may likely go up from here in the months to come,” he added.

Deloitte India Partner M.S. Mani said these collections, while being lower than the previous year-end month, pertain to supply transactions undertaken in April.

“While the collections in absolute terms are lower than the previous month — which had an embedded year-end impact — it reflects a continuation of the inherently good economic performance across states witnessed since last year,” Mani said.

“While the figures are comparatively moderate as compared to collections of April, however, that’s primarily on account of last fiscal year closure activities getting accumulated and accounted for in the collections of last month,” EY tax partner Saurabh Agarwal said.

Icra chief economist Aditi Nayar said GST revenues in May 2023 have modestly exceeded expectations.

“Over the next few months, we expect GST revenues to print at Rs 1.55-1.65 trillion and record an expansion of 10-11 per cent in YoY terms, broadly in line with the nominal GDP growth expected in FY2024,” Nayar said.

Sensex falls 193.7pts

Mumbai: Equity benchmark indices Sensex and Nifty ended lower in highly volatile trade on Thursday due to selling in banking, metal and energy counters amid a mixed trend in the global markets.

Falling for the second day in a row, the 30-share BSE Sensex declined 193.70 points or 0.31 per cent to settle at 62428.54 even after a positive beginning. During the day, it fell 263.1 points or 0.42 per cent to 62,359.14. The NSE Nifty fell 46.65 points or 0.25 per cent to finish at 18,487.75.

“Despite challenges in the global economies, the domestic market displayed better than estimated Q4 earnings growth, along with 7.2 per cent GDP growth in FY23, adding buoyancy to the market during the week.

“However, today the market closed with a marginal negative bias in which banks witnessed heavy profit-booking. Investors turned cautious in anticipation of inflationary pressure in the US after raising the US debt ceiling,” said Vinod Nair, head of research at Geojit Financial Services.

PTI