The growth in India’s services industry slumped to a six-month low in September because of a substantial easing in demand amid high inflation, a private survey showed.

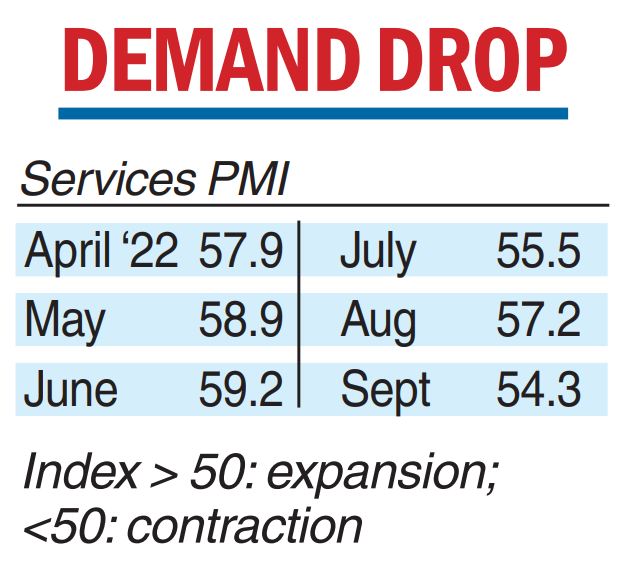

The S&P Global India Services Purchasing Managers’ Index fell to 54.3 in September from 57.2 in August.

Though PMI was above the 50-mark for the fourteenth straight month — the longest since October 2016 — the index fell to its lowest since March.

In Purchasing Managers’ Index (PMI) parlance, a print above 50 means expansion, while a score below 50 denotes contraction.“The Indian service sector has overcome many adversities in recent months, with the latest PMI data continuing to show a strong performance despite some loss of growth momentum in September,” said Pollyanna De Lima, economics associate director at S&P Global Market Intelligence.

The upturn was reportedly restricted by price pressures, an increasingly competitive environment and unfavourable public policies, the survey said.

Lima further noted that the steep depreciation of the rupee seen towards the end of the month because of interest rate hikes in the US present additional challenges to the Indian economy.

“Currency instability poses renewed inflation worries as imported items become more costly, and undoubtedly means that the RBI will continue hiking interest rates to protect the rupee and contain price pressures,” Lima said.

On September 30, the monetary policy committee (MPC) of the Reserve Bank of India (RBI) raised the key lending rate or the repo rate to 5.90 per cent — the highest since April 2019.

According to Lima, an upturn in inflation could damage consumer spending, dampen business confidence and test the resilience of the Indian service sector in the coming months.

Service providers were, however, strongly upbeat on growth prospects in September.

The survey further noted that weak external demand weighed on overall sales, with international orders declining further in the month. Monthly contractions have been recorded in each month since the onset of Covid-19.