The monetary policy committee of the RBI at their meeting earlier this month kept the key rates unchanged as a broad-based recovery from the pandemic was eluding the economy.

Inflation was expected to wane this year, which was another reason why the committee decided not to change the rates, minutes of the meeting released on Thursday showed.

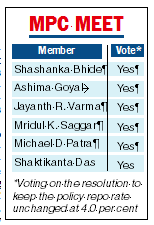

After a three-day meeting, the interest rate setting body on February 10 not only retained the key rates but five of its six members also voted to continue with the accommodative stance.

The panel also forecast lower than expected inflation numbers for the next fiscal, leading to expectations that a hike in the reverse repo rate will happen only in June.

The minutes showed the members calling for a watch on rising international crude oil prices even as some of them said India would not feel the pinch like some of the advanced economies.

According to RBI governor Shaktikanta Das, the trajectories of growth and inflation have continued to diverge between countries and this has led to some central banks embarking on aggressive policy tightening to quell inflation risks, while a few others, mostly emerging market economies, pursued with their accommodative policies.

Jayanth R. Varma continued to remain the hawk among the pack. He said as the third wave peters out in the country, the time has come to think of the objectives of monetary policy in much broader terms than “mitigate the impact of Covid-19 on the economy”.

Though a fourth wave cannot be ruled out, he said that the third wave has shown that the economy is no longer hostage to the pandemic even as geopolitical tensions have become a bigger risk to the global economy than the pandemic. According to Varma, a switch to neutral stance by the RBI is now long overdue and the “continued harping on combating the ill effect of the pandemic has become counter-productive’’.