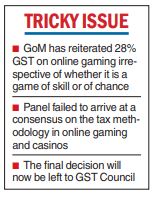

The group of ministers (GoM) on GST rates have failed to reach a consensus on the amount to be taxed in the case of online gaming and casinos. The panel is likely to stick with its earlier recommendation of a 28 per cent levy on these segments, while the final valuation mechanism will be lobbed on to the court of the GST Council.

The GoM, chaired by Meghalaya chief minister Conrad Sangma, had a virtual meeting on Tuesday to finalise their long pending report on the taxation of online gaming, casinos and horse-racing.

In online gaming, the state finance ministers’ panel (GoM) is likely to recommend a GST levy of 28 per cent irrespective of whether it is a game of skill or chance.

According to sources, a majority of the state ministers in the GoM were of the view that the GST on online gaming should be raised to 28 per cent. However, in the absence of a consensus on whether the tax should be levied on only the fees charged by the portal or the entire consideration, including the bet amount, received from participants, the GoM has decided to refer all suggestions to the GST Council for a final decision.

Online gaming at present attracts 18 per cent GST. The tax is levied on gross gaming revenue, which is the fees charged by online gaming portals on users.

The states reiterated their stand on the valuation mechanism and no consensus was attained with respect to taxing casinos, Chandrima Bhattacharya, Bengal’s minister of state for finance, told The Telegraph.

Bengal and Uttar Pradesh want the total bet value to be taxed. Goa has proposed an entry-point valuation mechanism for the chips purchased.

The states will now send their individual recommendations to create the final report before the next GST Council meeting, Bhattacharya said.

In horse racing, 28 per cent GST is expected to be calculated on the full value of bets placed with the bookmaker.

The sources said that there would not be any further deliberations at the GoM level, and the report would now be submitted to the GST Council for consideration.

The council, chaired by the Union finance minister and comprising her state counterparts, is the apex decision-making body for GST-related matters. It is expected to meet next month.

The GoM in its earlier report submitted to the council in June had suggested a 28 per cent GST on the full value of the consideration, including the contest entry fee, paid by the player, without making a distinction such as games of skill or chance. However, the council had asked the GoM to reconsider its report.

The GoM took the views of the attorney-general and also met stakeholders from the online gaming industry.

Although the minister’s panel deliberated on separate definitions for “games of skill” and “games of chance”, it finally decided to tax both as demerit goods attracting a 28 per cent GST.

The message has to be clear that online gaming is a demerit good. However, some relaxation in valuation methods could be provided.

The GoM report in June suggested that the GST should be levied on the entire amount received as consideration from the participant.

The sector experts had said that charging a 28 per cent GST on the entire amount, which a player deposits for a game for both categories of online game, would reduce the prize money left for distribution and drive away players from legitimate tax deducting portals.

This may also encourage online gamers to move towards unlawful portals that do not deduct tax.

Online gaming witnessed a spurt during the time of the Covid lockdown. According to a KPMG report, the online gaming sector would grow to Rs 29,000 crore by 2024-25 from Rs 13,600 crore in 2021.