Rollback

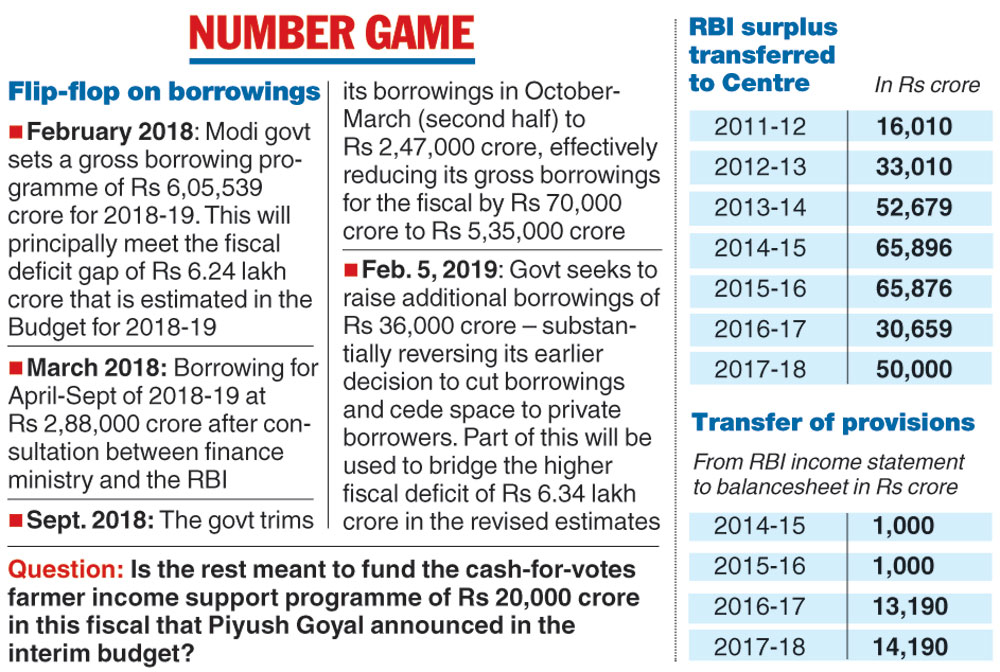

The government’s move to raise more borrowings amounts to a rollback of its decision in September 2018 to cut borrowings in the second half of the year (October-March) to Rs 248,000 crore — which in effect had meant a Rs 70,000-crore reduction in the government’s borrowing programme from a budgeted Rs 6.05 lakh crore to Rs 5.35 lakh crore.

At that time, the Modi government had made it look like a big, noble gesture to cede borrowing space to private industry which was being squeezed at that time because of the liquidity crunch in the financial system.

According to the borrowing calendar issued in September last year, the last tranche for borrowing through government bonds was to have been completed in the week ending March 8, 2019.

However, the government has now decided to borrow additional Rs 36,000 crore through two tranches of Rs 18,000 crore each during March 11-15 and March 18-22.

And it has kept the hatch open for more borrowings should the need arise.

“To enable institutional and retail investors plan their investments efficiently and provide transparency and stability to the government securities market, an indicative calendar for issuance of government dated securities for the remaining period of the fiscal year 2018-19 (February 4 to March 31) has been prepared in consultation with the RBI,” an official statement said.

“The calendar is subject to change, if circumstances so warrant, including for reasons such as intervening holidays.”

The government, in consultation with the RBI, reserves the right to exercise the greenshoe option to retain an additional subscription up to Rs 1,000 crore each against any one or more of the securities indicated in the auction notification, it said. However, the exercise of the greenshoe option will be within the overall notified amount for the auction, it added.

Just four days after the Narendra Modi-government presented a “full budget” for 2019-20, it is becoming increasingly clear that there’s a gaping hole in the budget math for the current fiscal that it is now desperately looking to fill through an off-budget exercise.

As a first step, the government has decided to raise an additional Rs 36,000 crore through dated securities or bonds — to fund its expenses during the current financial year.

But that is not all: the finance ministry also plans to claw back over Rs 27,000 crore worth of “provisions” that the RBI had made in 2016-17 and 2017-18 through a transfer of funds from the income statement of the central bank (popularly known as the profit and loss statement) to the balance sheet in line with the recommendations of the Malegam committee report of 2013 that had been accepted. Taken together, the government will be raising Rs 63,000 crore from these two measures.

At the same time, the government sought Parliament’s approval on Tuesday for gross additional expenditure of Rs 1.98 lakh crore for the current fiscal ending March 2019 as the third batch of supplementary demands for grants.

According to the document tabled in the Lok Sabha by finance minister Piyush Goyal, the net cash outgo will be Rs 51,433 crore. and the remaining amount matched by the savings of different ministries and enhanced recoveries.

Of the total net cash outgo, the document has pegged Rs 19,481 crore for the ministry of agriculture which will be used to make the proposed direct cash transfer of Rs 20,000 crore in this fiscal to 12 crore small farmers under the PM Kisan Samaan Nidhi — which has been dubbed as the cash-for-votes overture.

“It is not surprising that this government has brought the PM Kisan payout scheme in this financial year through a supplementary budget. By doing so, it is has technically protected the sanctity of the convention that interim budgets should not have any new scheme,” said Pronab Sen, former chairman of the Statistical Commission of India.

“The government can now safely argue that they are funding an existing scheme in the interim budget of 2019-20.”

The clawback

The move to claw back provisions made by the central bank amounting to Rs 13,190 crore in 2016-17 and Rs 14,190 crore in 2017-18 is part of a wider plan to dip into the reserves of the RBI — a move that eventually led to the standoff with former governor Urjit Patel and his exit.

In April 2013, the Malegam committee, which had been asked to review the template for the presentation of the RBI’s balance sheet and profit and loss account, had recommended all the unrealised valuation adjustments (gains/losses) should be routed through the profit & loss account, and the corresponding net transfers under various heads be shown as a single item in this account (income statement) under the heading “provisions”. It is these “provisions” that the Centre is now trying to claw back.

Meanwhile, finance ministry officials say the RBI will be expected to pay a surplus of Rs 69,000 crore in the next fiscal.

The Telegraph