Das is, however, used to the older regime where the RBI governor is no mere chairman or CEO of the central bank but a constitutional authority, North Block officials pointed out.

“It will have to be seen whether Das calls this meeting or delays it and gets his former colleagues in the finance ministry, who too will attend such a meeting, to help him in whittling down the powers of such committees or push back such initiatives so that the RBI governor remains Prima Uno (first one),” said the director of a Delhi-based state-run bank .

“There has been no governor who has willingly or without a fight given up any of his powers. Even the proposal to set up a Monetary Policy Committee by the government was agreed to after a prolonged fight by the RBI,” he said.

However, the government and the RBI are expected to find out a middle path on the issues raised by North Block.

The consultations between the finance ministry and the RBI were being held on three counts — transferring the RBI’s reserves as profits to the government, relaxing strict rules on lending for weak banks and conditions for loans to stressed power plants, including plants run by Adani, Essar and the Tatas.

The first of the government’s demand stems from its eagerness to somehow draw upon the RBI’s kitty to try and fund populist measures in a pre-election year.

The RBI on its part is reluctant to transfer the bulk of its reserve as it wants to keep some money for contingencies. Being the lender of the last resort, it may have to bail out stressed banks, including state-run banks, 11 of which are now under watch.

The Telegraph

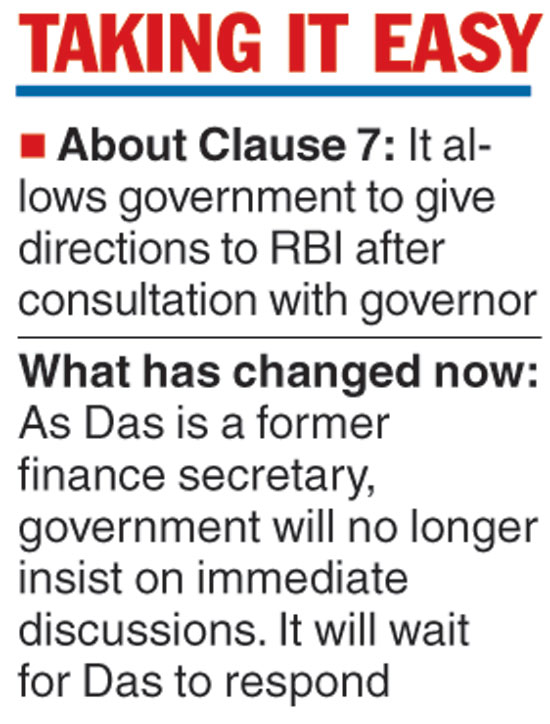

The government plans to go slow on Clause 7 negotiations with the RBI now that a former finance secretary is at the helm of affairs at the central bank.

With Shaktikanta Das’s appointment as the RBI governor, the government will no longer insist on an immediate discussion on Clause 7, which allows the government to give directions to the central bank after due consultation with the governor.

Top officials said North Block would now go slow and wait for Das to respond to the government’s concerns in informal discussions he is expected to hold with both the finance minister and the Prime Minister.

However, officials said the RBI board meeting slated for Friday, if held, could see demands being made by part-time directors for the setting up of committees to oversee some of the RBI’s functioning.

“Usually any board tries to get on top of the head of an institution before he has time to settle in,” said Pronab Sen, former chairman of the National Statistical Commission.

Urjit Patel, Das’s predecessor, was believed to be upset with the plan to appoint board committees to supervise the central bank’s functioning as traditionally the RBI governor and his deputies perform their functions independently and the board merely takes cognisance of administrative matters.

Das is, however, used to the older regime where the RBI governor is no mere chairman or CEO of the central bank but a constitutional authority, North Block officials pointed out.

“It will have to be seen whether Das calls this meeting or delays it and gets his former colleagues in the finance ministry, who too will attend such a meeting, to help him in whittling down the powers of such committees or push back such initiatives so that the RBI governor remains Prima Uno (first one),” said the director of a Delhi-based state-run bank .

“There has been no governor who has willingly or without a fight given up any of his powers. Even the proposal to set up a Monetary Policy Committee by the government was agreed to after a prolonged fight by the RBI,” he said.

However, the government and the RBI are expected to find out a middle path on the issues raised by North Block.

The consultations between the finance ministry and the RBI were being held on three counts — transferring the RBI’s reserves as profits to the government, relaxing strict rules on lending for weak banks and conditions for loans to stressed power plants, including plants run by Adani, Essar and the Tatas.

The first of the government’s demand stems from its eagerness to somehow draw upon the RBI’s kitty to try and fund populist measures in a pre-election year.

The RBI on its part is reluctant to transfer the bulk of its reserve as it wants to keep some money for contingencies. Being the lender of the last resort, it may have to bail out stressed banks, including state-run banks, 11 of which are now under watch.