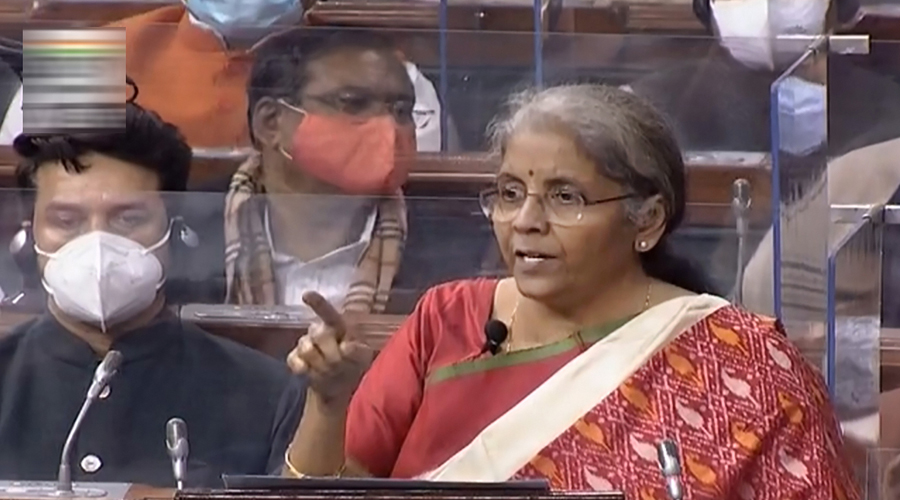

The government has lowered the period of reopening an assessment case to ensure greater compliance and build an environment of trust with the tax men, finance minister Nirmala Sitharaman said on Tuesday.

Finance ministry officials said the budget decision to reduce the reopening of an old assessment case to three years from six despite hesitancy from authorities had been made possible by advances in technology as more information gets collected from third parties.

For serious cases of evasion where there is evidence of concealment of Rs 50 lakh or more in a year, the assessment can be reopened after 10 years and that too with the approval of the principal chief commissioner of income tax.

Speaking at a session organised by Indian Chamber of Commerce on Tuesday, the finance minister said that the intent of the government has been to simplify the compliance for the tax payers and build trust between the tax authority and assessees.

“A step which I must say in the presence of the finance secretary..a step which entire CBDT and CBIC would normally hesitantly say yes to, they have readily said yes to collapse the time for keeping the option open for opening up an assessess’s account. The intent is not to bother the regular taxpayer,” said Sitharaman.

According to the finance ministry, due to the advancement of technology, the income tax department is now collecting all relevant information related to transactions of taxpayers from third parties under section 285BA of Income Tax Act. Information is also received from other law enforcement agencies. The department uses this information to verify declaration of tax payers and detect non filers .

Sitharaman said the budget had shown the direction in which the government wants to spend. It has also adopted a policy driven approach to stay away from the areas where it does not want to be in the first place.

This information driven assessment has brought about the opportunity to rationalise various provisions of the Income Tax Act and make it more friendly for the taxpayers.

Sitharaman said the budget had shown the direction in which the government wants to spend. It hs also adopted a policy driven approach to stay away from the areas where it does not want to be in the first place.

Members attending the event sought government intervention towards the rising steel prices and employment intensive tourism sector that has been affected by the Covid-19 pandemic.