Officials said the turf battle over payments regulation has to be contained as it could otherwise add to the headaches of the Narendra Modi government.

“A compromise will be discussed with the RBI … it cannot be decided in one meeting but will take several rounds of talks,” said officials.

The tussle over whether the RBI should be divested of this power began with the Centre’s stress on digital payments and the desire to bring in a more modern mechanism that would be in sync with new payments banks such as those being run by mobile companies.

However, the RBI pointed out that other countries with higher percentage of digital payments such as in the US still have their central banks regulating the system.

The setting up of the board has been suggested as part of a draft Payment and Settlement System Bill 2018, by a committee, headed by economic affairs secretary Subhash Chandra Garg, which also had IT secretary Ajay Prakash Sawhney, UIDAI chief executive Ajay Bhushan Pandey and RBI executive director S. Ganesh Kumar as members. An earlier Wattal Committee had suggested a payments board under the RBI.

The RBI’s attempt to force global digital firms such as Google to move their financial transaction data

storage to India led to its own complications with both the European Union and the US trying to stall the move by lobbying with the government.

Last year, the RBI and the Centre were at loggerheads over moves to curb the central bank’s powers of determining how to deal with a bank which went bust.

The now-withdrawn Financial Resolution and Deposit Insurance Bill, infamous for its controversial “bail-in” clause, also had a clause to set up a resolution corporation.

The central government plans to sit with the Reserve Bank of India and work out a compromise on the proposed payments regulator as it fears that the central bank’s strong objection could create problem for the legislative mechanism to set up such a watchdog.

Top officials said the RBI’s note dated October 19 had placed the finance ministry’s plans to come up with amendments to the Payment & Settlement Systems Act “in jeopardy”.

The RBI’s strongly worded objections will turn Parliament’s attention to this issue and it could turn into a political issue soon, feel officials.

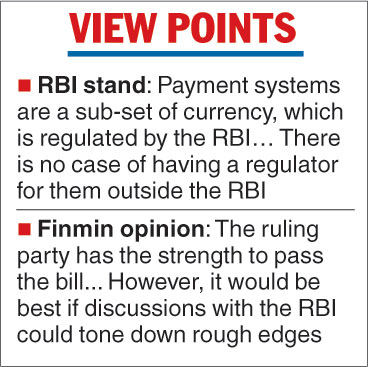

“The ruling party has the strength to pass the bill in the Lok Sabha and it being a money bill, the Rajya Sabha can only delay it and not stop it. However, it would be best if further discussions with the RBI could tone down the rough edges and bring about a consensus,” top officials said.

In its dissent note, the RBI has said: “Payment systems are a sub-set of currency which is regulated by the RBI… There is an underlying bank account for payment systems which is under the purview of the banking system, vested with the RBI.”

It had gone on to say: “There is no case of having a regulator for payment systems outside the RBI … The Payments Regulatory Board (PRB) must remain with the Reserve Bank and be headed by the governor of the Reserve Bank of India. It may comprise three members nominated by the government and the RBI with a casting vote for the governor to ensure smooth operations of the board.”

The Telegraph