The government has announced record capital spending aimed at boosting jobs and economic growth in its budget while cutting personal tax rates as it seeks to woo voters ahead of next year’s general elections.

The go-for-growth spending ramp-up proposed by Finance Minister Nirmala Sitharaman in her fifth annual budget presentation to Parliament comes as the government also aims to curb the fiscal deficit.

The government is targeting “facilitating ample opportunities for citizens, providing a strong impetus to growth and job-creation and stabilising the macro economy,” she said.

The budget, which got high marks from analysts, is the last full one before the government goes to the polls in the 2024 elections. The aim is to “benefit all sections of society” and is the “first budget in Amrit Kaal” as India marches toward its 100th birthday, Sitharaman said.

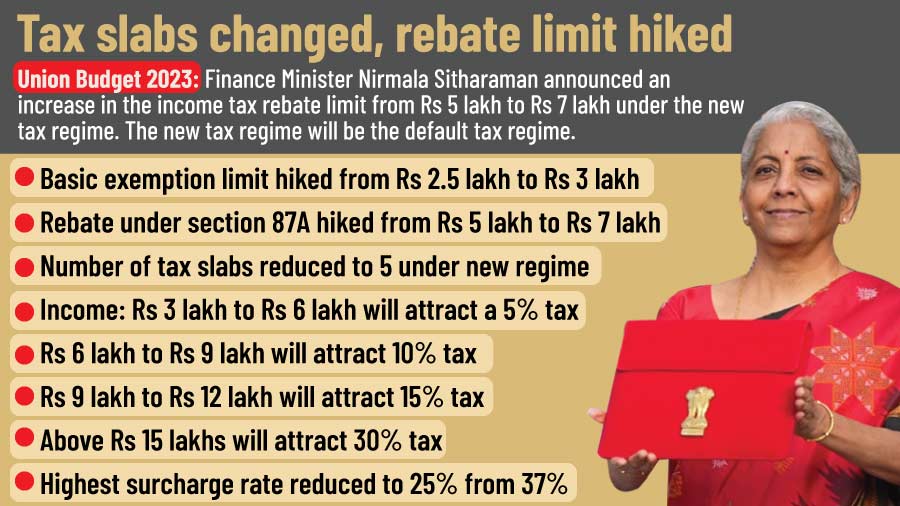

The government is revising all tax slabs, a tax relief move that will cost the public coffers Rs 350 billion in revenues annually but the budget forecasts largely buoyant revenue on the back of strong economic growth to offset the loss.

“Currently those earning under Rs 5 lakh do not pay any tax. I propose to increase the rebate to Rs 7 lakh,” Sitharaman said in her budget speech which was her shortest yet at 90 minutes.

New tax regime

The tax changes, though, will apply only to people who opt for the new tax regime and not those who stay with the old one. The government is aiming to make the new, no-exemptions scheme more attractive to Indians though taxpayers will still be able to file their taxes under the old scheme that includes exemptions.

Analysts reckon that many middle-class taxpayers, especially those who have housing loans and insurance policies for which they get tax exemptions, will not move to the new tax regime. If they do, they will lose the exemptions that come from these schemes. One analyst speculated that high net worth individuals would opt for the new tax regime, but a large chunk of the middle class would stick with the old regime for now.

The budget calls for increasing capital spending by 33 per cent to Rs 10 trillion to boost the economy and create jobs. In a bid to increase in employment in the jobs-rich construction sector, the government is hiking spending by 66 per cent spending to Rs 790 billion on the PM Awas Yojna affordable housing scheme.

Boost consumption

"The middle class is India's power," Prime Minister Narendra Modi said in a speech after the budget, referring to the cuts in personal tax rates.

Analysts said the tax changes should boost consumption. “it would leave more people with extra money in their (middle-class taxpayers) hands and a smile on their faces,” said Srikanth Subramaniam, chief executive of Kotak Cherry.

B. Gopkumar chief executive of Axis Securities, called the budget “extremely well-balanced” and “focused on growth driven by capital expenditure.” Plans to cut the deficit suggests “a considerable degree of prudence” while “relief to the middle class on the income tax front is the cherry on the cake," he added. Lakshmi Iyer, investment advisory chief executive at Kotak Investment Advisors, pronounced it “a bull’s-eye budget satisfying most strata of the society.”

Insurance firm shares fall

But while Indian shares initially shot up after the budget, they reversed their gains, led by a fall in insurance companies on the budget’s plan to curb tax exemptions for insurance taken out by people. Adani Group shares also tumbled for a fifth straight trading day, bringing down the market. The Nifty 50 index closed down 0.26 at 17,616.30 points – the worst budget day performance by the Nifty in three years – while the BSE Sensex ended up just 0.3 per cent at 59,708 points.

One sector which received the budget with mixed feelings was travel and tourism. While the government is hoping to boost inward travel, it has hiked tax deducted at source on overseas tour packages from 5 per cent to 20 per cent. For people who want to send remittances abroad to buy property or make other investments also the tax deducted at source has also been hiked from 5 per cent to 20 per cent.

For the elderly, under the senior citizen savings scheme, the maximum investment limit has been doubled to Rs 30 lakh from Rs 15 lakh. For non-government salaried employees who are retiring, the limit of Rs 3 lakh for tax exemption on leave encashment – last fixed in the year 2002 – is being hiked to Rs 25 lakh.

Narrow budget deficit

At the same time as offering the tax relief, the government aims to narrow the budget deficit to 5.9 per cent of gross domestic product from an estimated 6.4 per cent this year. By 2023-24, the government hopes to cut the fiscal deficit to 4.5 per cent of GDP.

It’s part of the government’s efforts to clean up its finances and boost its credit rating, now at the lowest investment grade level, which will boost investor trust in the economy.

But there are losers under the budget. It has earmarked only 600 billion rupees towards a rural jobs guarantee scheme, which is the lowest in years. It’s also cut spending in real terms – stripping out inflation – under the National Social Assistance Scheme for women, child development and maternity benefits.

Health, education allocation?

“The budget did not talk about allocation to health and education, which is a worry for future growth prospect as India remains one of the weakest spenders on these areas globally,” noted Kunal Kundu, India economist at Societe Generale

The health budget was raised to Rs 889.5 billion from Rs 709.4 billion last year. The government has hiked education spending to Rs 1.13 trillion for the Rs current year from Rs 999 billion in the previous 12 months.

India’s economy is expecting 6-6.8 per cent growth in the current financial year, down slightly from last year’s estimated 7.0 per cent expansion. But even with the slight slowdown, India’s growth will be the fastest of all major economies, Sitharaman said.

'India a bright star'

“The world has recognised India as a bright star,” she said.

Overall spending in real terms, spending in the next fiscal year will rise less than 3 per cent while borrowing will provide a massive 34 per cent of funding. Corporation tax will contribute 15 per cent, income tax will kick in 4 per cent and customs revenues will contribute 4 per cent. Goods and services taxes will comprise 17 per cent of the budget funding.

The rise in capital expenditure marks the third steep increase in a row,” Sitharaman said. As part of this infrastructure thrust, 50 additional airports, heliports, water aerodromes, and advanced landing zones will be revitalised.

100 infra projects

Also, 100 critical transport infrastructure projects for steel, ports, fertiliser, coal, foodgrain sectors have been identified with an investment of Rs75,000 crore including Rs 15,000 crore from private sources.

The government plans to increase spending for roads by 24.4 per cent to Rs 2.7 trillion this year. It has earmarked capital spending of a record Rs 2.4 lakh crore for the railways. But defence outlays have been raised marginally to Rs 5.94 trillion rupees against a revised figure of Rs 5.85 trillion rupees for the last financial year.

The “economy is on the right track” despite the “massive slowdown” globally caused by the pandemic and the Russia-Ukraine war, Sitharman added.

She noted that India’s economy has increased in size from being in 10th position globally to fifth largest in the last nine years since Modi took power in 2014.

Seven priorities

She outlined seven main priorities in the budget that included development of infrastructure and investment and the financial sector, “green” economic growth and an emphasis on “unleashing the potential” of the economy. “

As part of efforts to fulfil those goals, the government has identified 100 infrastructure projects for “first- and last-mile connectivity” that will receive investment of Rs 75,000 crore, including Rs 15,000 crore from private sources, she said.

The government will spend Rs 35,000 crore on clean energy transition and to meet its net-zero climate goals.

AI for India

The government aims to realise the “vision of Make AI (artificial intelligence and make AI work for India” and three Centres of Excellence for AI will be set up in top educational institutions.

To boost smaller businesses, Rs 9,000 crore will be injected into a revamped credit guarantee scheme to enable Medium Small and Medium Sized Enterprises (MSMEs) to access additional collateral-free credit of Rs 2 lakh crore.

Moody’s said it liked the narrower deficit forecast, saying it “underscores the government’s commitment to longer-term fiscal sustainability and supports the economy amid high inflation and a challenging global environment.”