The Centre has decided to pull the plug on the plan to privatise Bharat Petroleum Corporation Ltd (BPCL).

The country’s second largest oil marketing company was envisioned as the tour de force of India’s disinvestment programme ever since the Union cabinet first approved plans to sell its 52.98 per cent stake in the petroleum refiner back in 2019.

The BPCL selloff plan has ground to a halt because only one bidder — Anil Agarwal’s Vedanta Ltd — was left in the fray after two US-based private equity players walked out over the lack of clarity over fuel pricing.

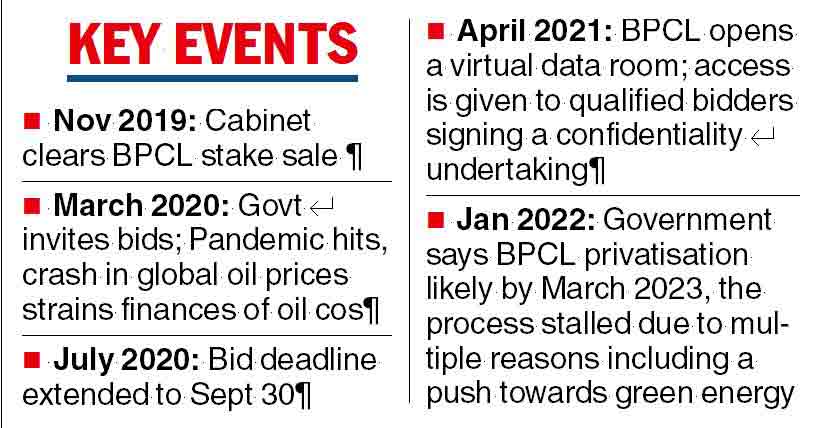

The BPCL selloff has had a chequered history since March 2020 when the government first invited expressions of interest (EOIs).

None of the global oil giants, including Aramco of Saudi Arabia, put in bids as investor interest in the selloff veered from exuberant enthusiasm in the initial stage to phlegmatic indifference — the mood swing supposedly in response to the pandemic-induced crisis that had hollowed out profitability and soured appetite for fresh investments.

“We are in a single bidder situation and it doesn’t make sense for the single bidder to dictate the narrative. So, the disinvestment process is stalled for now,” said a source who did not wish to be identified.

Mining mogul Anil Agarwal’s Vedanta group and US venture funds Apollo Global Management Inc and I Squared Capital Advisors had expressed interest in buying the government’s 53 per cent stake in BPCL. But the two funds withdrew after failing to rope in global investors amid waning interest in fossil fuels.

The government had not invited financial bids, the source said. The government was supposed to seek financial bids once bidders completed due diligence and the terms and conditions of the share purchase agreement were finalised.

The writing was on the wall after DIPAM secretary Tapan Kanta Pandey said recently that the government did not intend to rush into selling the second-biggest state-owned refiner, which has over 14 per cent of the country’s oil refining capacity.

The government may take a fresh look at BPCL privatisation, including revising the terms of sale. “We need to go back to the drawing board on BPCL,” one official had said a couple of weeks ago.

There is a possibility that the government may decide to now offer to sell only a 26 per cent stake at this stage with management control. This will limit the amount of money a bidder has to put upfront to buy the company.

At the current trading price of BPCL on the stock market, the government’s 53 per cent stake is worth over Rs 38,000 crore. On top of this, the bidder would have had to shell out another Rs 18,700 crore towards an open offer to minority shareholders. If the government were to sell a 26 per cent stake, the financial outgo of the bidder would total no more than Rs 37,000 crore.

The government has not made any formal statement on withdrawing the stake sale of BPCL.

Last week, Vedanta Chairman Anil Agrawal had told PTI that the government had withdrawn the offer to sell its stake in BPCL and would come up with a new strategy.

BPCL is India's second-largest oil marketing company after Indian Oil, and with refineries in Mumbai, Kochi, and Madhya Pradesh, it has the third-largest refining capacity after Reliance and Indian Oil.

Industry sources said petrol price was deregulated in 2010 and diesel in 2014 but the government continued to have a say in the pricing of the two fuels.

For the record, the petroleum ministry maintains that oil companies have the freedom to decide on pricing, but prices are put on hold every time there are elections in the country.

Indian Oil, BPCL and Hindustan Petroleum Corporation Ltd (HPCL) held prices for a record 137 days between November 2021 and March 2022 during assembly elections in five poll-bound states despite the increase in international crude oil prices.