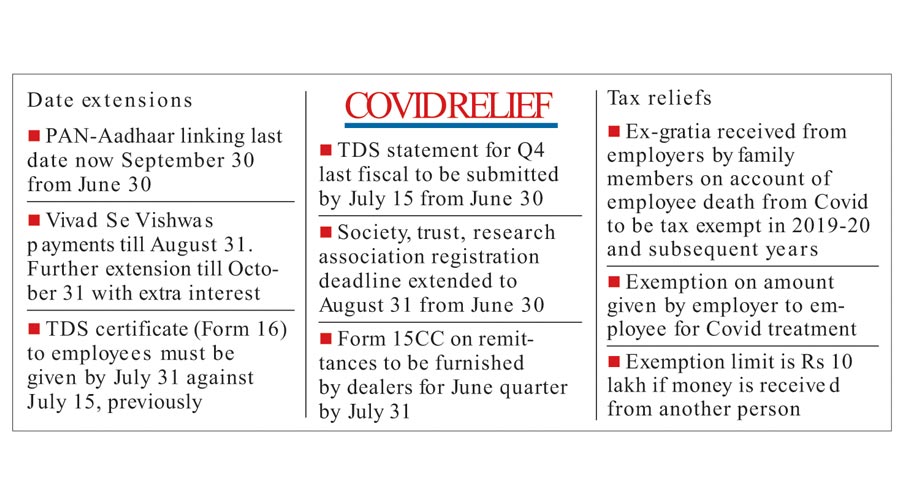

The government on Friday extended the deadlines for various income tax compliances and also exempted from tax the amount given by an employer to employees for Covid-19 treatment.

Ex gratia payments received from employers by family members in case of employees’ death because of Covid would be exempt from income tax in fiscal 2019-20 and subsequent years.

The limit for such tax-exempted payment would be Rs 10 lakh in case it is received from any other person.

Along with these reliefs, the government extended the deadline for a bunch of tax submissions.

The deadline for making payments under the Vivad Se Vishwas direct tax dispute resolution scheme has been extended by two months till August 31. Taxpayers have the option to make payments till October 31 with an additional amount of interest.

The last date for PAN-Aadhaar linking has been extended by three months to September 30, 2021.

The date for furnishing Tax Deducted at Source (TDS) certificate in Form 16 to the employees by employers has been extended till July 31 from July 15, 2021.

In case of taxing capital gains arising out of transfer of residential house property, the CBDT said for relief in taxation, the re-investment deadline would be September 30, 2021 for such capital gains.

“Taxpayers intending to claim the exemption in respect of sums received during FY 2019-20 would need to revise their return of income to claim refund of tax paid. Hence, it is expected that the government may also extend the due date for filing a revised return for Assessment Year 2020-21.

Taxpayers shall have to carefully read the fine print to check the applicable deadlines as a diverse set of dates have been prescribed under different sections,” Kumarmanglam Vijay, partner, J Sagar Associates, said.

Tax expert Narayan Jain said, “The exemption for amount received for Covid treatment or amount received on death of Covid patient is a humanitarian decision. We welcome the extension of various timelines.’’