The Union cabinet has approved the much awaited 5G spectrum auction, paving the way for the sale of nearly 73GHz of radiowaves that will not only open the door to high-speed telecom services but also boost government revenues.

Soon after the green signal from the cabinet on Wednesday, the department of telecom released the notice inviting bids for the 5G auction which will start on July 26.

Sources said the rollout may begin in August in a phased manner. Going by the stipulated base price, the entire spectrum put up for sale is worth at least Rs 4.31 lakh crore, they said.

The cabinet also approved spectrum allocation for private captive networks — overriding the objections of the telecom players, who are against the entry of new entities in the 5G business.

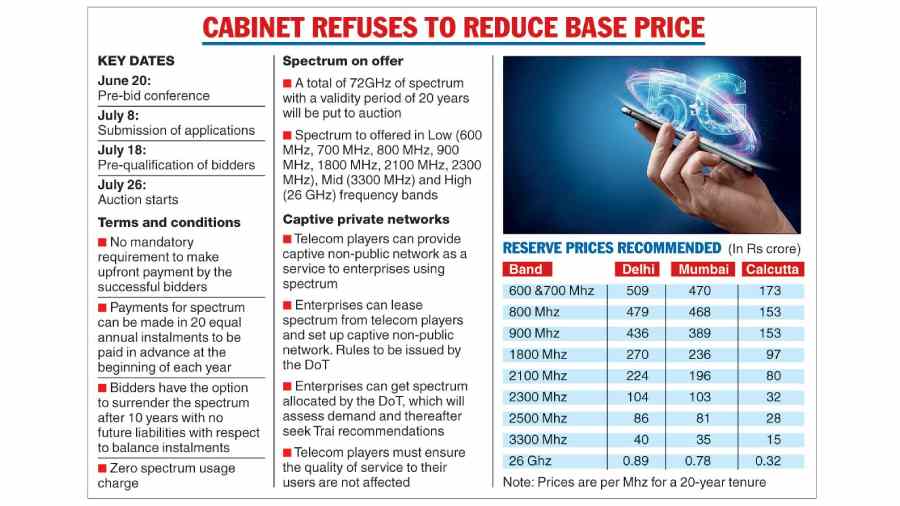

A total of 72,097.85 MHz of spectrum with a validity period of 20 years will be put to auction by the end of July 2022.

Spectrum in various frequency bands — low (600 MHz, 700 MHz, 800 MHz, 900 MHz, 1,800 MHz, 2,100 MHz, 2,300 MHz), mid (3,300 MHz) and high (26 GHz) — will be auctioned.

Prashant Singhal, EY Global TMT Emerging Markets Leader said “one of the key highlights of the 2022 spectrum auction is abolishing spectrum usage charges (SUC). This is a positive move and is in line with Trai’s recommendation”. SUC varies between 3 per cent and 5 per cent of adjusted gross revenue (AGR) depending on the year of the acquisition of spectrum.

There is no mandatory requirement to make upfront payment by the successful bidders, a government release said. Payments for spectrum can be made in 20 equal annual instalments to be paid in advance at the beginning of each year.

The bidders have been given the option to surrender the spectrum after 10 years with no future liabilities with respect to balance instalments.

“The availability of sufficient backhaul spectrum is also necessary to enable the roll-out of 5G services. To meet the backhaul demand, the cabinet has decided to provisionally allot 2 carriers of 250 MHz each in E-band to the telecom service providers,” the release said.

Muted bidding

The decision not to reduce the reserve price comes as a blow to Bharti Airtel, Reliance Jio and Vodafone Idea. Analysts warned this could result in muted bidding.

The Cabinet has approved 5G auctions at reserve prices recommended by sector regulator Telecom Regulatory Authority of India (Trai), officials said. Trai had earlier recommended a 39 per cent reduction in the reserve or floor price for the sale of 5G spectrum for mobile services compared with the prices announced in 2018.

The industry is expected to shell out around Rs 1-1.1 lakh crore on the 5G auction, despite telcos’ reservations over high spectrum prices, Icra said but cautioned that sector debt level is likely to rise.

Ankit Jain, vice-president and sector head, corporate ratings, Icra Ltd, said the regulator has come out with relaxed payment terms, which allow telcos to pay for the spectrum in 20 instalments thus ensuring very low upfront outgo.

“This also avoids any dent in the liquidity position and is likely to boost participation. This makes the basis for Icra’s assumption of the participation in the upcoming spectrum auction to be around Rs 1.0-1.1 lakh crore, in which the upfront payment is likely to be close to Rs 10,000 crore only,” Jain said.

According to Icra, while the upfront payment will be low, the participation will lead to an addition in deferred spectrum liabilities, and in turn, the total debt of the industry.

"Debt continues to remain a vulnerable point for the industry. Icra expects industry debt levels to increase to around Rs 5.7 lakh crore as of March 31, 2023, before moderating to Rs 5.3 lakh crore as of March 31, 2025."

Jaideep Ghosh, chief operating officer of Shardul Amarchand Mangaldas & Co, said “the wide availability of spectrum across all bands is encouraging as potential bidders can opt for spectrum bands and quantum as per their strategy. Having said that, the base prices for spectrum remain an issue for the bidders who were expecting a much lower price."