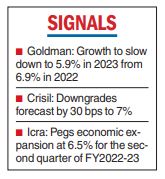

Goldman Sachs has forecast that India’s economic growth will slow down to 5.9 per cent in 2023 from 6.9 per cent in this calendar year as monetary tightening impacts demand as the benefits of the post-Covid reopening start to fade.

“We expect growth to be a tale of two halves in 2023, with a slowdown in the first half (due to dwindling reopening effects),” Santanu Sengupta, India economist at Goldman Sachs, said in a note.

Sengupta added that in the second half, growth will re-accelerate as global growth recovers, the net export drag declines, and the investment cycle picks up.

The monetary policy committee of the RBI has projected real GDP growth of 7 per cent for the current fiscal. For the first quarter of 2023-24, it forecast growth of 7.2 per cent.

According to the US investment bank, India’s growth in the first seven months was faster than most emerging markets after they reopened.

Sengupta said headline inflation will drop to 6.1 per cent in 2023 from 6.8 per cent in 2022. Pointing out that government intervention was likely to cap food prices, he added that upside risks to service inflation are likely to keep core inflation sticky at 6 per cent.

Goldman Sachs expects that the RBI will raise rates by 50 basis points in December 2022 and by 35 basis points at its following meeting in February 2023, thereby taking the repo to 6.75 per cent. He however, feels that the worst is over for the rupee as the dollar is near its peak.

Crisil, Icra lower rating

Crisil and Icra on Monday revised down their India growth projections for the current fiscal and the second quarter mainly due to the ripple effect of slowdown in global growth and mixed crop output.

Crisil downgraded the India growth forecast by 30 bps to 7 per cent, while Icra pegged the economic expansion at 6.5 per cent for Q2-FY-2023.

“We have revised down our forecast because of the slowdown in global growth that has started to impact our exports and industrial activity. This will test the resilience of domestic demand,” Crisil chief economist Dharmakirti Joshi said in a note.

Aditi Nayar, his counterpart at Icra, attributed the lower numbers to the mixed crop output trends from the advance estimates of kharif, adverse input cost movements for certain sectors with a higher fuel intensity.

With inputs from PTI