Global supermajor BP Plc’s exclusivity with Reliance Industries has ended but the energy giant will continue to pursue oil and gas as well as mobility ventures in India with the Mukesh Ambani firm owing to an unwritten strategic partnership, BP’s outgoing India head Sashi Mukundan said.

BP in 2011 spent $7.2 billion to acquire a 30 per cent interest in 23 oil and gas blocks of Reliance. Eastern offshore KG-D6 block was the cornerstone of the deal that also provided for a 10-year exclusivity period which meant that BP would take up energy projects or investments in India only in partnership with Reliance.

The firm has so far invested more than $12 billion across the energy value chain, including bringing on stream three new deepwater natural gas projects in KG-D6 that account for one-third of India’s gas production.

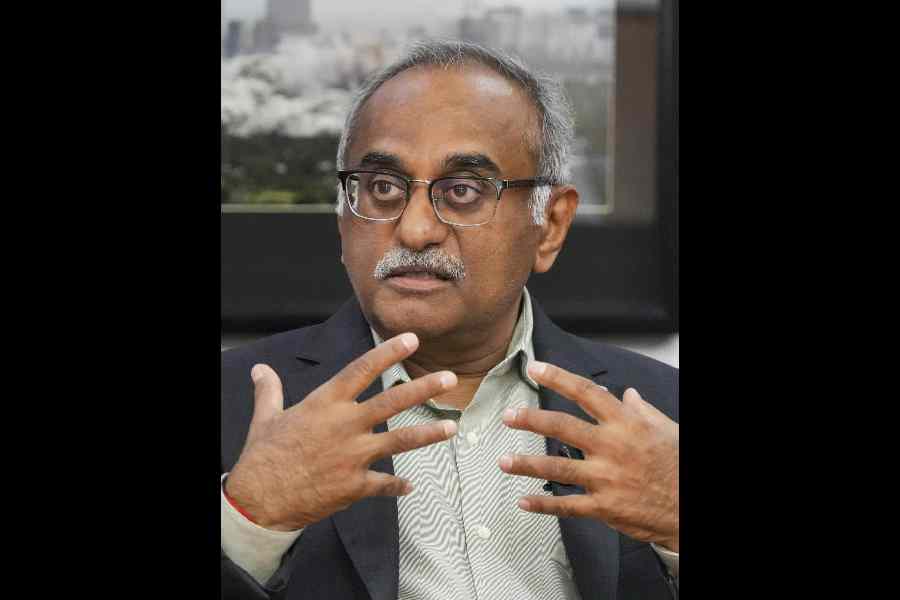

“We started working with Reliance as early as 2005 when first (the then BP CEO) Lord John Browne visited India,” Mukundan said.

It finally fructified in the 2011 deal. “Thirteen years since we did the upstream deal, not once have we gone back and looked at the contract,” he said, adding the partnership with Reliance is not a contract based but one based on “trust and relationship”.

“So anytime we have any issues between the two partners, we just sit face to face. I just have to make a call or (send a) WhatsApp (message) and say I want to come and see you. And you know, between him (Mukesh Ambani, chairman and managing director of Reliance Industries Ltd) and PMS Prasad (executive director at Reliance), we resolve everything,” he said.

Mukundan said the original deal for stake in upstream oil and gas exploration and production assets has grown into the retail partnership and EVs and continues to grow.

“In the (2011) contract, the exclusivity was for 10 years. That expired. But there is an unwritten... I wouldn’t call it agreement, but it’s an unwritten feeling that, basically, we are their strategic partner, and they are our strategic partner,” he said.