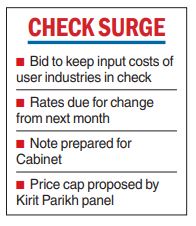

The Union cabinet is likely to soon consider imposing caps or a ceiling on price for the majority of natural gas produced in the country to keep input costs for users ranging from CNG to fertiliser companies in check, sources said.

The government bi-annually fixes prices of locally produced natural gas — which is converted into CNG for use in automobiles, piped to household kitchens for cooking and used to generate electricity and make fertilisers.

Two different formulas govern rates paid for gas produced from legacy or old fields of national oil companies such as Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) and that for newer fields lying in difficult to tap areas such as deepsea. T

The global spurt in energy prices post Russia’s invasion of Ukraine has led to rates of locally produced gas climbing to record levels — $8.57 per million British thermal unit for gas from legacy or old fields and $12.46 per mBtu for gas from difficult fields.

These rates are due for revision on April 1. Going by the current formula, the prices of gas from legacy fields are slated to climb to $10.7 per mBtu with minor changes in rates for gas from difficult fields, two sources with knowledge of the matter said.

Rates of CNG and piped gas for kitchens have already jumped 70 per cent because of previous gas price hike and would climb further, if April 1 rate revision happens.

Sources said the government had last year constituted a committee under Kirit Parikh to look at revision in gas prices that balances both local consumer and producer interest, while at the same time advances the country’s cause of becoming a gas-based economy.

The committee has recommended changing the indexation for gas from legacy fields to 10 per cent of prevailing Brent crude oil prices instead of current practice of using rates of gas in surplus nations to decide their price.

This, however, would be subject to a floor or base price of $4 per mBtu and cap or ceiling price of $6.50, they said.

At current Brent crude oil price of $75 per barrel, the price of gas should be $7.5 per mBtu but the fuel would be priced only at $6.5 due to the cap.

While leaving the formula for difficult fields unchanged, the panel suggested the price band for current production from legacy or old fields, which make up for twothirds of all gas produced in the country and is currently under the administered price mechanism, or APM, until a full deregulation of prices is implemented in 2027.

The panel suggested a 50 cents per mBtu increase in the $6.50 ceiling every year to slowly move toward the marketing and pricing freedom for APM fields.

Sources said inter-ministerial consultations on the committee recommendations are over and a note for consideration of the Cabinet, largely accepting the recommendations, has been moved.

The cabinet is likely to consider it soon, they said.