The finance ministers of the G20 nations have called for swift and co-ordinated implementation of the G20 road map to deal with the issues related to crypto assets.

The road map was spelt out in a synthesis paper prepared by the International Monetary Fund (IMF) and the Financial Stability Board (FSB).

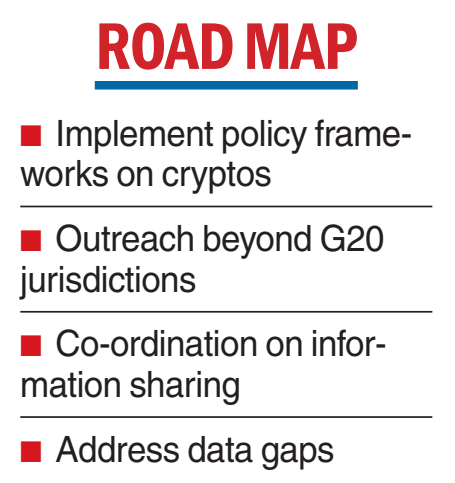

"We adopt the road map proposed in the synthesis paper. We call for swift and co-ordinated implementation of the road map, including implementation of policy frameworks; outreach beyond G20 jurisdictions; global co-ordination, co-operation and information sharing; and addressing data gaps," said a communique issued during the fourth meeting of the FMCBG (The Finance Ministers and Central Bank Governors).

The road map is a detailed and action-oriented document that will help co-ordinate global policy as well as develop mitigating strategies and regulations on such assets while also taking into consideration the specific implications on emerging markets and developing economies (EMDEs).

The communique was unanimously adopted at the fourth and final meeting of the G20 FMCBG in Marrakesh on the sidelines of the IMF-World Bank annual meetings.

Development banks

About strengthening multilateral development banks (MDBs), the communique said that the ministers committed themselves to pursuing ambitious efforts to evolve and strengthen MDBs to address the global challenges of the 21st century with a continued focus on addressing the development needs of low and middle-income countries.

"We re-emphasise the need for an additional push for continued and further impetus for ambitious implementation of the recommendations of the G20 Independent Review of MDBs capital adequacy frameworks (CAFs) within MDBs' governance frameworks while safeguarding their long-term financial sustainability, with a regular review of the progress of implementation on a rolling basis...," it said.

The board of each MDB will be best placed to determine if and when a capital increase is needed in addition to CAF measures.

Appreciating the critical step taken by the Financial Action Task Force (FATF) in finalising guidance on trusts and other legal arrangements, the communique said "we commit to effectively implement the associated revised standard on beneficial ownership transparency".