The appellate bankruptcy court in New Delhi has asked the Ruia family to pay the overdue loan of the entire Essar group before it can propose to take Essar Steel out of the ongoing insolvency process.

The observation of the National Company Law Appellate Tribunal (NCLAT) came a day after a lower court in Ahmedabad formally approved a rival revival plan of ArcelorMittal to take over debt-laden Essar, ignoring the plea of the Ruia family.

Advocates appearing on behalf of the three directors of Essar Steel at the behest of the the existing promoters — brothers Sashi and Ravi Ruia — have sought a week’s time to respond to the suggestion of NCLAT, which, however, would take up other applications in the Essar Steel case on Friday.

Ahmedabad NCLT had rejected the Rs 54,389-crore settlement proposal put forward by the Essar group, promising to pay the dues of all classes of creditors in full under section 12A of the Insolvency & Bankruptcy Code.

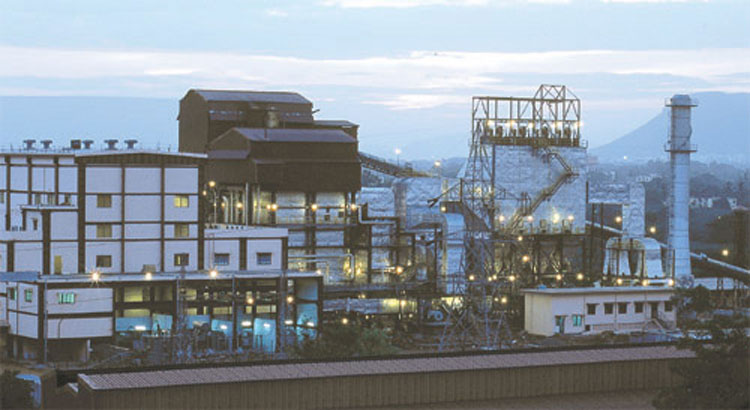

Even though the NCLT had accorded conditional nod to the rival plan of ArcelorMittal on March 8, the signed copy of the order was only made available on March 13, putting in motion the final lap of the keenly contested legal tussle to take over the Gujarat-based steel plant.

When the verbal order was read out last week, the Essar group continued to argue that its proposal was way better than ArcelorMittal, which is only offering Rs 42,202 crore for the 8-million-tonne steel asset.

However, the observation made by the NCLAT puts the focus back on the October 4 judgment of the Supreme Court which had held both ArcelorMittal and the Ruias-backed Numetal to be ineligible under section 29A of the Code and asked them to pay the overdue loans linked to all the non-performing loan accounts of their groups.

While Arcelor paid around Rs 7,000 crore as overdues linked to the two NPA companies, Numetal did not. Instead, the Ruia promoter firm directly approached bankers and bankruptcy courts to withdraw the steel company out of the insolvency process under Section 12A of the Code.

It now appears that the NCLAT observation has put a spanner into the settlement proposal. Essar promoters, however, plan to litigate against the NCLT approval on Friday, along with Standard Chartered Bank, which is also opposing the ArcelorMittal plan, as it is getting a pittance against claim.

NCLT Ahmedabad, while approving the ArcelorMittal plan, made repeated suggestion in the order to set aside 15 per cent of the Rs 42,202 crore for operational and other creditors, while distributing the rest among all financial creditors, including Standard Chartered, equally.

Sources said the committee of creditors are undecided as the NCLT had only made a suggestion and not given any direction. “The lenders may approach the NCLAT to seek a direction in the matter, despite ArcelorMittal willing to close the deal by paying off the creditors,” they pointed out.

Financial creditors, other than StanChart, are getting 85 per cent of their admitted claim compared with operational creditors who are getting just about 4 per cent. StanChart, which initiated the bankruptcy proceedings against Essar along with the SBI, will get 1.7 per cent under the Arcelor plan.