State-owned refiners HPCL and BPCL suffered heavy losses as a freeze on petrol and diesel prices badly crimped refining margins.

The losses arose because of the erosion in marketing margins on motor fuel and LPG.

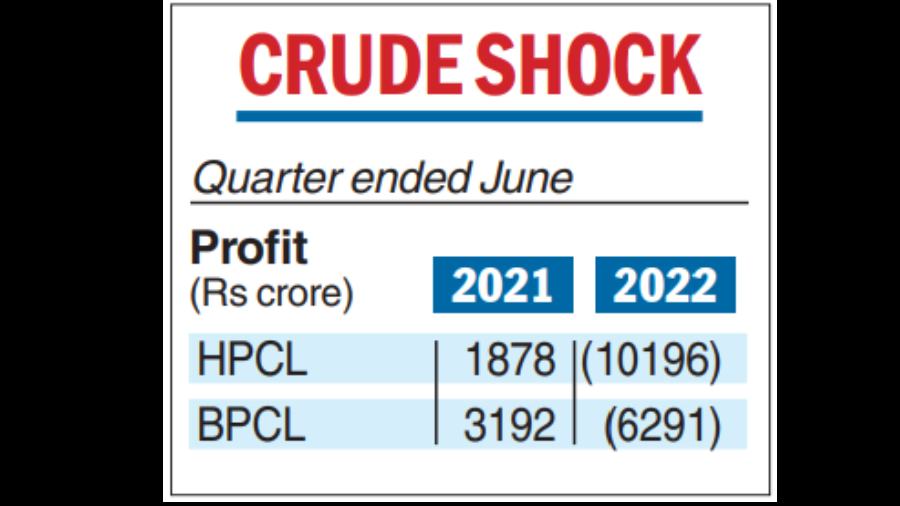

HPCL recorded the highest ever standalone net loss of Rs 10,196 crore for the June quarter compared with a profit of Rs 1,900.80 crore in March and Rs 1,878.46 crore in the corresponding quarter last year.

Besides, the company took a hit of Rs 945.40 crore towards loss on account of foreign currency transactions.

Bharat Petroleum Corporation Ltd (BPCL) reported a net loss of Rs 6,291 crore in the first quarter compared with a profit of Rs 3,192.58 crore in the same period a year back, the company said in a statement.

Revenue from operations rose to Rs 1.38 lakh crore from Rs 89,688.98 crore in AprilJune 2021.

HPCL’s revenue from the sale of products soared to Rs 1.21 lakh crore in the first quarter of the current fiscal year from Rs 77,308.53 crore a year back. This is mostly because of higher international oil prices. This is the biggest quarterly loss that HPCL has ever incurred.

These losses negated record refining margins. HPCL earned $16.69 on turning every barrel of crude oil into fuel at the refinery gate as opposed to a gross refining margin (GRM) of $3.31 per barrel in AprilJune 2021.

BPCL earned $27.51 on turning every barrel of crude oil into fuel in the quarter against $4.12 per barrel gross refining margin a year back. But this was negated by losses that were incurred because of holding fuel prices despite rising costs.

BPCL said it had a negative EBITDA of Rs 5,461.56 crore in Q1 versus a positive Rs 5,308.52 crore last year. EBITDA margin was at negative 4 per cent in Q1 FY 22-23 against 6 per cent in Q1 FY 21-22.

The basket of crude oil India imports averaged $109 per barrel but the retail pump rates were aligned to about $85-86 a barrel cost. IOC too reported a net loss of Rs 1,992.53 crore for the June quarter.

Loss for IOC, which is nearly double the size of HPCL, was smaller as it had vast oil refining and petrochemical businesses to offset some of the losses on fuel marketing. HPCL on the other hand sells more fuel than it produces.