Do not judge me by my successes, judge me by how many times I fell and got back up again.

That quote, attributed to Nelson Mandela, pretty much sums up today’s hallowed theme: financial freedom with mutual funds.

Mutual funds, as any committed investor would agree, are tried and tested investment avenues for all. Investors, big and small, can use them to pursue their principal objectives.

Of these, capital appreciation and income generation, happen to be the two most critical goals for their fraternity. But that is not the reason why Mandela’s words ring true in this context.

The real reason why they are so relevant is the manner in which funds can withstand the mighty test of time. Down today, and up tomorrow — the great cyclicality of advance and decline — is why funds are so appropriate for the investing masses.

Let’s keep this simple, and for the time being, forget all the other advantages that funds pack in. I ask you to ignore their low costs, professional management, possibility of generating alpha.

I also ask you to forget about the ease and convenience of operating a portfolio of funds. Instead, I ask you to focus exclusively on the market’s eternal upheavals.

You see, the Sensex did not climb to its current perch of 66000 points in one day. There were countless advances, followed by lots of declines; one jerky movement followed another; it was a roller-coaster worth the thrill.

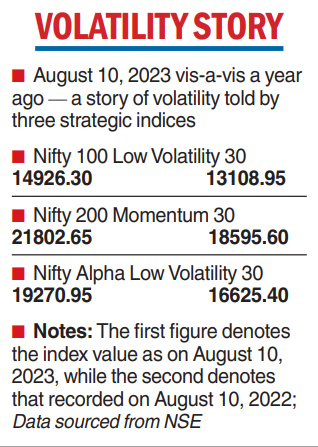

Yet, thrill loses its currency if the risk associated with it does not fetch returns. And funds have generally scored well — not always a perfect 10 — a trend evident in

the positive numbers thrown in by many fund managers.

The 3 key lessons

In the context of cyclicality, you have every right to ask, how should an ordinary investor behave? I wish to answer that with three homilies.

1. Stay right through the cyclical course, a series of ups and downs should not burden you needlessly if you want long-term capital appreciation.

2. While your fund manager is on his way to alpha, you have some standard tasks to perform. I will, for the sake of brevity, identify three of these. One, always remain focused on your risk profile. Your portfolio should not deviate from it.

Two, when asset allocation has been done and performance

has been weighed, analyse your holdings deeply. If you need to rebalance, do it. Three, never forget your constant adversaries — inflation and taxation. As for the former, there is very little you can do. But as for the latter, you must explore all tax-saving possibilities.

3. Do the right things by pursuing smart strategies. Ergo, if profit booking is warranted, do not hesitate. If you want to switch or withdraw, do not feel queasy. And, above all, have no qualms about allocating fresh money for justifiable causes.

Beat the cyclicality

A word or two about cyclicality and the manner in which you may strategise. For normal, diversified, open-end equity funds, systematic investment plans are the perfect idea. These tools keep the concept of timing away from the equation. Here, an investor stays with the fund irrespective of market conditions. This comes across as a specific benefit for those who think long-term.

At the other end of the spectrum is the narrower option. I am referring to sector-specific or theme-oriented funds. These appear in many varieties. Yet the ordinary investor has to walk cautiously when it comes to allocation.

In recent years, the returns of many sector funds have spurted during short periods of exuberance.

Remember the experience garnered by pharma funds during and after Covid. This, I am sure, will pose a lesson for pharma fund loyalists.

Cyclicality will be broken by trends, both positive and negative, acting in favour of or against investors’ interest. Those who can smoothly ride the relentless waves can hope to generate wealth and spawn regular income.

The Mandela quote will come handy for such investors. Those who get perturbed — that is, redeem early, switch needlessly or take profits at the earliest opportunity — will face challenges of a very different kind.

The writer is director of Wishlist Capital Advisors