Net foreign portfolio investment into Indian equities has registered an outflow in January (till January 19, 2024). This metric has seen significant volatility - from the highs at the end of 2020 to a decadal low in 2022 and recovery in the last three quarters of 2023.

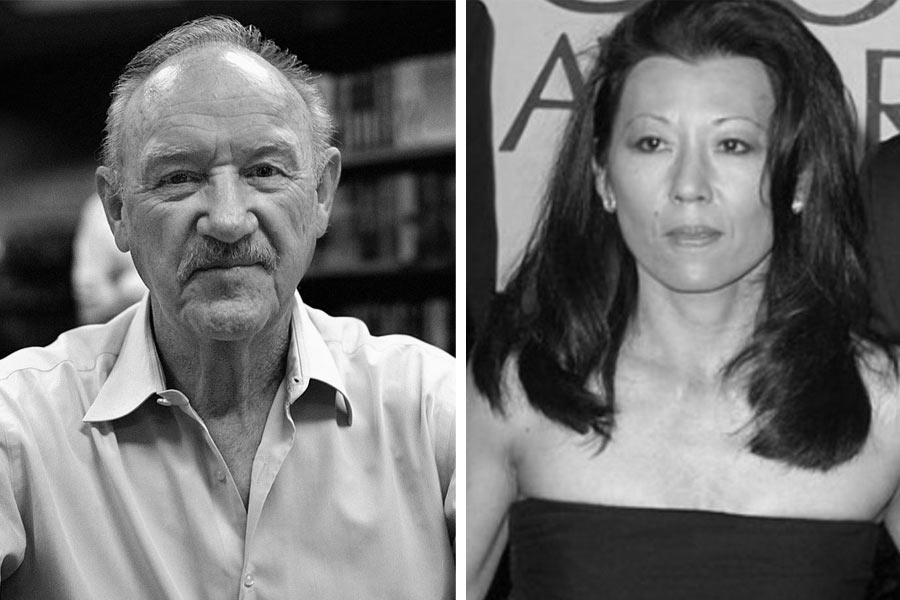

Subhrajit Roy, India head — global capital markets, Bank of America, in an interview with Pinak Ghosh from The Telegraph gives an outlook on FPI investment trends, valuations of the Indian market compared with emerging markets along with expectations for qualified institutional placements (QIPs), initial public offers (IPOs) and block sales in 2024.

Q: The narrative of the Indian economy among market observers is one of strong fundamentals with optimistic forecasts about growth in the coming years. Yet we have seen FPI equity inflows at a decadal low. What does this trend show and how are the FPI flows being perceived?

A: I think FPI holding of around 16 per cent of India’s equity assets under management needs to be seen in the light of a substantial rise in domestic investor holding led by a sustained surge in retail inflows. India has been an emerging market favourite and hence we have seen a rise in its emerging market index weightage (~16 per cent MSCI EM weight).

However, absolute foreign investor inflows into India will always be a function of the appetite towards emerging markets, which in turn will be driven by global risk appetite and rating outlook. When global risk appetite improves, as we saw last quarter onwards, India will be a big beneficiary of such inflows ($7 billion in December 2023 alone).

We expect this trend to continue as strong Indian macro now gets aligned to improvement in global risk appetite.

Q: The Nifty price-earnings ratio (P/E) was 22.61 as of December 2023, while the P/E for MSCI emerging markets was 14.54 as of December 29, 2023. Are Indian markets overvalued?

A: Indian markets have always traded at a premium to broader emerging markets on account of relatively more stable macroeconomy, consistent growth outperformance and better return on equity. The current premium (~60 per cent) is in line compared to historical averages.

Q: In the domestic market, there were three significant trends in 2023 — IPOs gaining momentum (40 of 57 IPOs in 4 months of the year), a jump in qualified institutional placements (45 companies mobilising Rs 54,350 crore) and large block sales. Will this trend persist in 2024?

A: Indian IPO market was one of the shining spots globally and we expect this trend to strengthen this year. We expect the average size of IPOs to become larger in 2024 and the IPO calendar to be diversified across sectors led by technology, healthcare and financial institutions groups (FIG).

We started seeing a pickup in QIPs in 2023 led by FIG names, the largest being $1 billion Bajaj Finance QIP led by BofA. We should see more corporates look to raise primary proceeds through QIP to fund growth and/or acquisitions.

Indian markets also saw a robust block sale volume in 2023 (~$11 billion). The bulk of them were by financial sponsors whose investments in these companies would have seasoned for monetisation and there was a large corresponding investor demand to absorb the same as well.

Indian markets have matured to handle large block trades of companies which are performing well and hence we believe this will be a more consistent trend.