Foreign investors have been betting big on the services sector despite the Narendra Modi government’s high-octane push to boost manufacturing through the ‘Make in India’ initiative, a domestic rating agency said on Wednesday.

India Ratings and Research also said a bulk of the foreign direct investment (FDI) in manufacturing is not greenfield or fresh investments, which should otherwise be the aspirational aspect.

“This could be because doing business in the services sector is less complicated than doing business in the manufacturing sector in India,” the agency, an arm of Fitch Ratings, said.

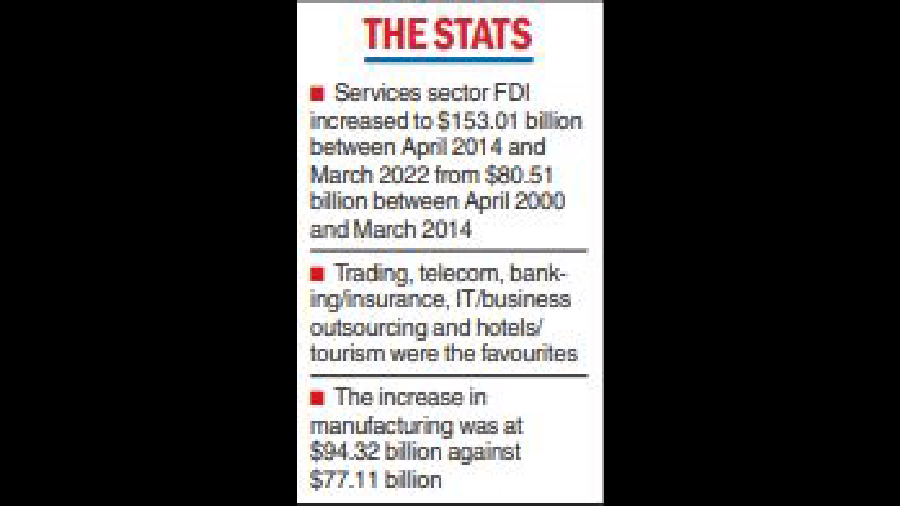

It said services sector FDI increased to $153.01 billion between April 2014 and March 2022 against $80.51 billion between April 2000 and March 2014.

The increase in the manufacturing sector was not as fast at $94.32 billion against $77.11 billion in the corresponding period.

In 2014, India launched a flagship programme called ‘Make in India’ to facilitate investments across sectors, but with a special focus to build a world-class manufacturing sector and followed it up with the PLI scheme across 14 manufacturing sectors.

The services sector accounted for the highest share of FDI between 2000 and 2014 as well, the agency said, adding that within services, trading, telecommunications, banking/insurance, IT/business outsourcing and hotels/tourism were the favourites.

In manufacturing, the FDI has been concentrated in segments such as auto, chemicals, drugs and pharmaceuticals, metallurgical and food processing.

Computer software and hardware have done well, where the FDI increased to $72.7 billion between April 2014 and March 2022, from just $12.8 billion between April 2000 and March 2014, the agency said.

This sector witnessed further traction after the roll out of the PLI (production linked incentive) scheme with major global brands such as Apple, Samsung, Flextronics, and Nokia announcing big investments in India.

The agency said the country has done well among emerging markets in terms of FDI, with its share increasing to 6.65 per cent in 2020 and declining due to Covid to 2.83 per cent in 2021.