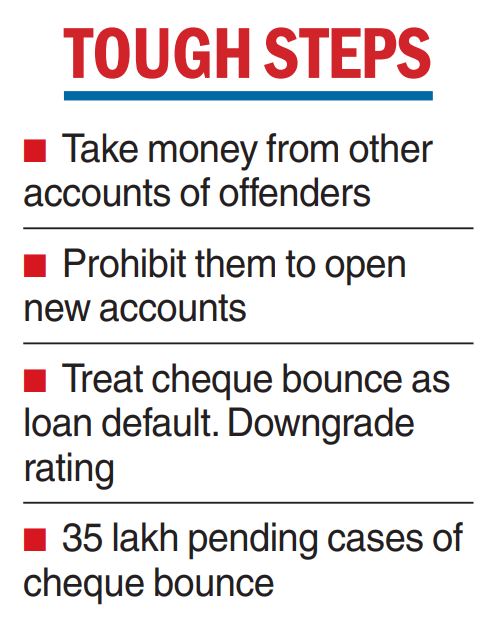

The finance ministry is mulling several steps such as dipping into the other accounts of a cheque issuer and prohibiting the opening of new accounts to deal with cheque bounce cases that are clogging the legal system.

Many suggestions were made at a high-level meeting recently called by the ministry to deal with the high incidence of cheque bounce cases.

Some of the steps suggested before taking legal recourse included debiting other accounts of cheque issuers if their account is short of funds to honour the instrument, sources said.

The other suggestions were treating cheque bounce as the default of loan and thus reporting to credit information companies for necessary downgrade of the score, the sources said, adding a proper legal view would be taken before these suggestions are accepted.

If these suggestions are implemented, it would help enforce cheque honouring by the payers without the matter going to court and also compel them to make payment by creating a deterrent through technology.

These measures would help promote ease of doing business and dissuade people from wilfully indulging in the issuance of cheques even though their accounts have insufficient funds.

Proposed steps could be implemented through the integration of data across the banks, sources said.

Section 138 of the Negotiable Instruments Act, of 1881 deals with the dishonour of cheques due to insufficiency of funds in the account. A complaint for dishonour of a cheque under Section 138 of the Act can be filed in the court situated at a place where the bank of the payee is located. It is a punishable offence with a fine that can extend to twice the amount of the cheque or imprisonment for a term not more than two years or both.

When an issuer presents a cheque to the bank for payment and it is returned unpaid by the bank due to insufficient funds, the cheque is said to have bounced.

Peeved at a large number of pending cases of cheque bounce, the Supreme Court had constituted a committee with a mandate to suggest steps to be taken for early disposal of about 35 lakh pending cases across the country.

During the hearing, the Centre had “in principle accepted” the need for creating additional courts to deal with such cases.

The SC-constituted committee had recommended procedural reforms, full use of technology, and augmentation of infrastructure to ensure that disputes are resolved swiftly.

Besides, the panel suggested some changes in the Negotiable Instruments Act, of 1881.

Industry body PHDCCI recently urged the finance ministry to take measures like compulsory suspension of bank withdrawals for a few days to make the cheque issuers accountable.

The government should enact a law that from the date of dishonouring of the cheque, the dispute between the two parties must be settled within 90 days through mediation, the chamber has suggested.