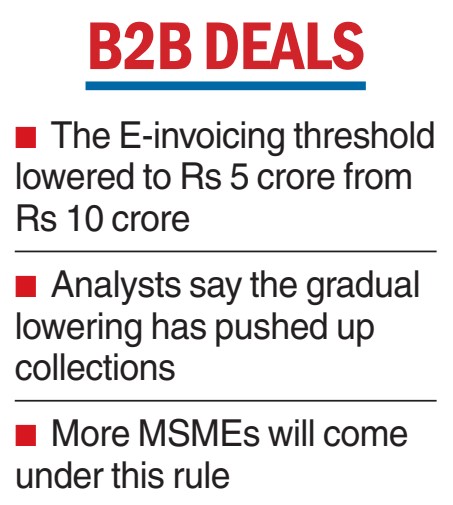

The finance ministry has lowered the B2B e-invoicing threshold to Rs 5 crore from Rs 10 crore with effect from August 1.

Tax analysts said the gradual reduction in the threshold has contributed to higher GST collections.

However, businesses would have to modify their supply and distribution activities to ensure compliance with the rule.

The finance ministry on Wednesday notified the reduction in the threshold.

Shashi Mathews, partner IndusLaw, said: “A larger base of assesses will now be required to comply with the e-invoicing requirements. It is understood that the government has plans to further reduce it to Rs 1 crore. Failure to comply would mean that the underlying supply has been made without an invoice recognized under the GST laws.”

The government initially had a threshold of Rs 500 crore that has been lowered periodically to Rs 5 crore.

Deloitte India partner leader indirect tax Mahesh Jaising said more MSMEs would come under the rule. "For companies, e-invoicing is a boon rather than a bane as suppliers who are e-invoicing compliant result in proper flow of input tax credit and reduce the churn around credit issues," Jaising said.

AMRG & Associates senior partner Rajat Mohan said the phased implementation of e-invoicing has resulted in reduced disruptions, improved compliance and increased revenue.

"Inclusion of MSME sector would benefit the ecosystem by reducing costs, rationalising errors, ensuring faster invoice processing and limiting commercial disputes."

I-T dept raids Mankind premises

New Delhi: The Income Tax department on Thursday conducted raids on the premises of Mankind Pharma over allegations of tax evasion, official sources said.

Company premises and plants in Delhi and nearby locations are being covered and documents are being checked apart from the questioning of company executives as part of the searches launched early in the morning, they said.

The action came two days after the company made its stock market debut on Tuesday.

In a BSE filing, Mankind Pharma said it was extending “full cooperation” to the department.

“We hereby inform you that the Income Tax Department is searching for some of the premises/plants related to the company and some of its subsidiaries.

“The officials of the company and its subsidiaries are cooperating with the officials of the Income Tax Department and are responding to the queries raised by them,” it said. This action, the company said, has had no impact on its operational performance.

PTI