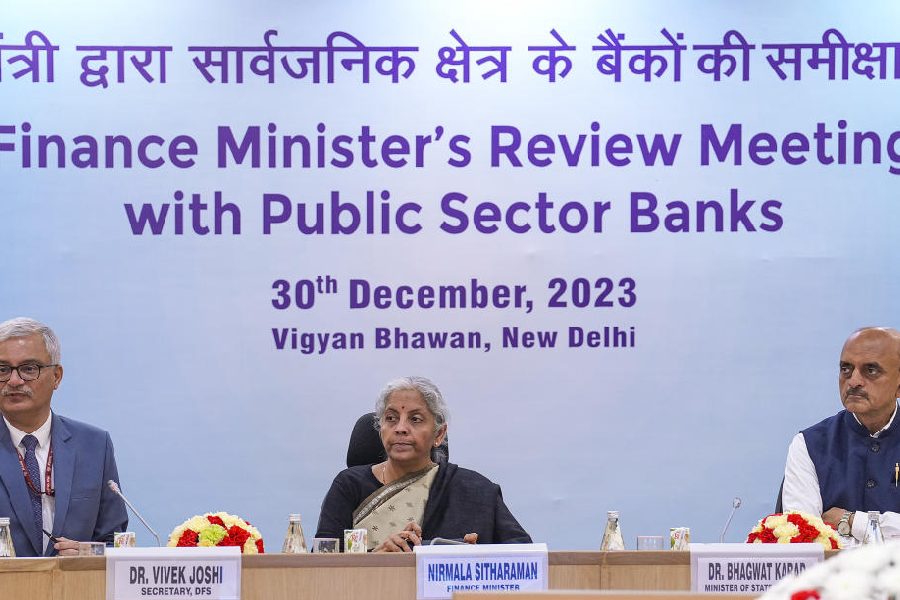

Finance minister Nirmala Sitharaman on Saturday asked public sector banks to increase due diligence before loan disbursement to ensure responsible lending practices across the board.

“The wilful defaults not only strain the banks’ financial health but also hamper the flow of credit in the economy. The Union finance minister instructed the PSBs to enhance due diligence before loan disbursement, ensure regular monitoring of large loan accounts, and undertake swift and thorough legal action in cases of such default,” a finance ministry release said.

Sitharaman asked the “banks to take strict administrative action against the conniving officials of the banks who enable fraud and wilful defaults”.

Recognising that the effectiveness of legal action against defaulters before courts and tribunals largely depends on effective representation by lawyers and attorneys assisted by bank officials, Sitharaman called for a performance review of counsel representing PSBs.

Earlier this month, the finance ministry informed Parliament that a total of 10 public sector banks (PSBs) have transferred non-performing assets (NPAs) of over Rs 11,617 crore to NARCL between January and November this year.

In a written reply to a question in the Rajya Sabha, the minister of state for finance Bhagwat Karad said the National Asset Reconstruction Company Ltd (NARCL) has recovered Rs 16.64 crore as on November 30.

Sitharaman emphasised the importance of mobilising deposits, urging PSBs to innovate and offer attractive deposit schemes to enhance their deposit base, which will also enable them to extend more credit.

The minister stated that the issues of cyber security should be seen from a system perspective as a small vulnerability can be used by nefarious elements to create system-wide risks.

Cybersecurity

There is a need to adopt proactive cybersecurity measures and implement stringent security protocols to protect sensitive financial information and systems from cyber-attacks.

The finance minister exhorted the banks to adapt to the evolving digital landscape, ensuring that the integrity of domestic financial systems remains uncompromised.

Asking the banks to ensure privacy of customer data, she said that coordination between banks, security agencies, regulatory bodies and technology experts is necessary to create a more resilient financial ecosystem against potential cyber-security threats.

This is the probably the last full review meeting before the presentation of Budget 2024-25 and general elections later next year.

On the performance front, PSU banks have earned a net profit of about Rs 68,500 crore during the first six months of the current financial year.

During 2022-23, it said banks’ balance sheets grew at a healthy pace, with both deposits and credit growth accelerating.

The gross non-performing assets (GNPA) ratio of scheduled commercial banks (SCBs) fell to a decade low of 3.9 per cent at the end of March 2023 and further to 3.2 per cent in September.

The improvement in asset quality of banks that began in 2018-19 continued during 2022-23. The GNPA ratio stood at 3.2 per cent in the April-September period of the current fiscal.