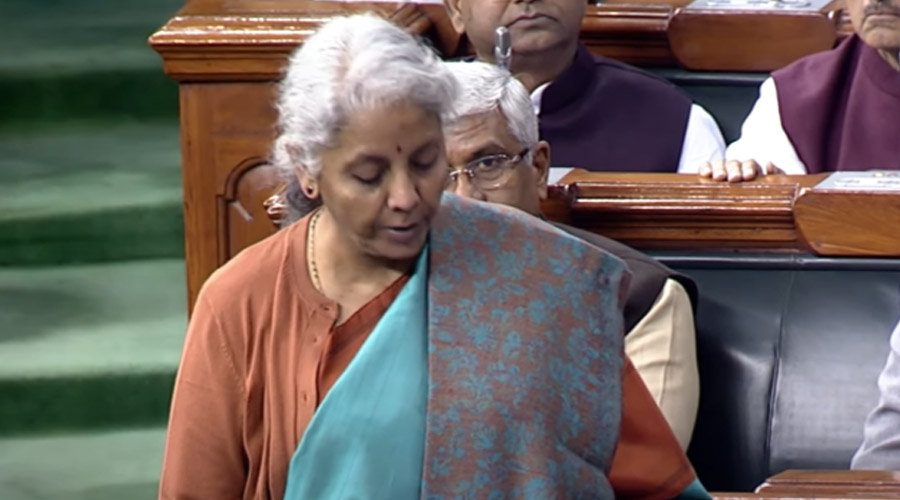

India's economic growth is forecast to be 6.5 per cent in fiscal 2024, according to the Economic Survey released by the government on Tuesday, a day ahead of the Union Budget presentation, the fifth by Finance Minister Nirmala Sitharaman since 2019.

Following are the highlights of the Economic Survey 2022-23 tabled in Parliament on Tuesday:

ADVERTISEMENT

- India's economy to grow 6.5 pc in 2023-24, compared to 7 pc this fiscal and 8.7 pc in 2021-22

- India to remain the fastest growing major economy in the world

- GDP in nominal terms to be 11 pc in next fiscal

- Growth driven by private consumption, higher capex, strengthening corporate balance sheet, credit growth to small businesses and return of migrant workers to cities

- India third largest economy in PPP (purchasing power parity) terms, fifth largest in terms of exchange rate

- Economy has nearly "recouped" what was lost, "renewed" what had paused, and "renerengised" what had slowed during the pandemic and since the conflict in Europe

- Real GDP growth to be in the range of 6-6.8 pc next fiscal depending on global economic, political developments

- India's recovery from the pandemic was relatively quick, growth next fiscal to be supported by solid domestic demand, pick up in capital investment

- RBI projection of 6.8 pc inflation this fiscal outside the upper target limit, not high enough to deter private consumption, also not too low to weaken inducement to invest

- Borrowing cost may remain 'higher for longer', entrenched inflation may prolong tightening cycle

- Challenge to rupee depreciation persists with the likelihood of further interest rate hikes by the US Fed

- CAD may continue to widen as global commodity prices remain elevated, economic growth momentum stays strong

- If CAD widens further, rupee may come under depreciation pressure

- Overall external situation to remain manageable

- India has sufficient forex reserves to finance CAD and intervene in forex market to manage rupee volatility

- Elevated downside risks to global economic outlook as inflation persisting in advanced economies and hints of further rate hikes by central banks

- Inflation did not "creep too far above" tolerance range compared to several advanced nations

- The growth in exports has moderated in second half of current fiscal; the surge in growth rate in 2021-22 and first half of current fiscal led to production processes shifting gears from 'mild acceleration' to 'cruise mode'

- Slowing world growth, shrinking global trade led to loss of export stimulus in the second half of current year

- Schemes like PM KISAN, PM Garib Kalyan Yojana significantly contributed to lessening impoverishment

- Credit disbursal, capital investment cycle, expansion of public digital platform and schemes like PLI, National Logitics Policy and PM Gati Shakti to drive economic growth

- Bank credit growth likely to be brisk in FY24 on back of benign inflation, moderate credit cost

- Credit growth to small businesses remarkably high at over 30.5 pc in January-November, 2022

- Housing prices firming up after release of pent-up demand, decline in inventories

- Central govt capex grew 63.4 pc in April-November of current fiscal

- India's economic resilience has helped it withstand the challenge of mitigating external imbalances caused by the Russia-Ukraine conflict without losing growth momentum

- Stock market gave positive retruns in calendar year 2022 unfazed by FPI withdrawal

- India withstood extraordinary set of challenges better than most economies

- After a dip in FY21, GST paid by small businesses has been rising and now crossed pre-pandemic levels reflecting the effectiveness of targeted government intervention

- Private consumption, capital formation led economic growth in current fiscal has helped generate employment; urban employment rate declined, while Employee Provident Fund registration rose.

This is a breaking news. Please refresh the page for recent updates.