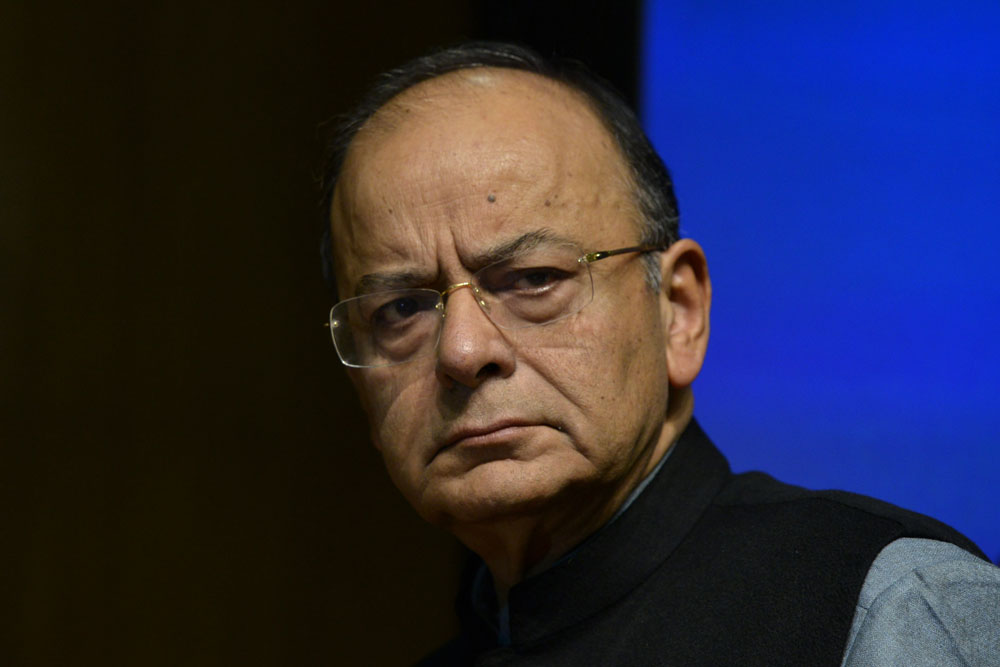

Union finance minister Arun Jaitley has said the government does not need more money from the Reserve Bank of India in the next six months and rejected charges that the Centre is eyeing the central bank’s funds to come out with populist schemes ahead of the general elections next year.

Jaitley’s comments to a TV channel come days after a central board meeting of the RBI where the 18-member body decided to constitute an expert committee to examine the economic capital framework (ECF) of the RBI.

The membership and terms of reference of the panel will be jointly determined by the Centre and the RBI.

Pointing out that the Centre does not need any extra funds from the central bank or any other institution to meet the fiscal deficit target, Jaitley observed that the surplus funds that may accrue from the new capital framework of the RBI can always be used for poverty alleviation programmes over the years by future governments.

“We don’t need any extra funds from any other institution to finance our fiscal deficit. Let’s be very clear that’s not the intention of the government. And we are not saying that in the next six months, give me some money. I don’t need it... All we are saying is there has to be some discussion and some norms under which the Reserve Bank will have a capital framework,” the minister said in an interview to a television channel.

The ECF, which refers to the capital required by the central bank to handle various risks, determines the surplus that the RBI transfers to the government. While the RBI follows a July-June financial year, it had transferred a surplus of Rs 50,000 crore to the government for the year ended June 2018.

The Centre wants to relook the level of reserves as it feels the RBI holds excess amount. The total reserves with the RBI at the end of the last financial year (2017-18) stood at Rs 9.6 trillion. This includes Rs 2.32 trillion held in a contingency fund and nearly Rs 6.92 trillion in the currency and gold revaluation account.

While there were reports that the government was eyeing Rs 3.6 trillion of reserves held by the RBI, this was denied by North Block. Economic affairs secretary Subhash Chandra Garg had said the Centre was not in any dire need of funds.

and that there was no proposal to ask the RBI to transfer this amount. He had added that the Government is also on track to meet its fiscal deficit target of 3.3 per cent for the current fiscal.

While contingency fund is a provision meant to meet unexpected and unforeseen contingencies, including depreciation in the value of securities, the RBI holds a CGRA which reflects unrealized gains or losses on valuation of foreign currency assets and gold.

The friction between the Centre and the RBI in the run-up to the November 19 meeting of the central board, has seen the opposition accusing the Government of undermining the RBI’s independence. Former finance minister P Chidambaram had alleged that hat the central government was determined to 'capture' the RBI to gain control over its reserves.

While there were reports that the Government was eyeing Rs 3.6 trillion of reserves held by the RBI, this was denied by North Block. Economic Affairs Secretary Subhash Chandra Garg had said that the Centre was not in any dire needs of funds and that there was no proposal to ask the RBI to transfer this amount. He had added that the Government is also on track to meet its fiscal deficit target of 3.3 per cent for the current fiscal.