Merger and acquisition (M&A) experts were sent into a tizzy after the government introduced an amendment in the Finance Bill 2021 that changed the tax treatment for slump sale transactions.

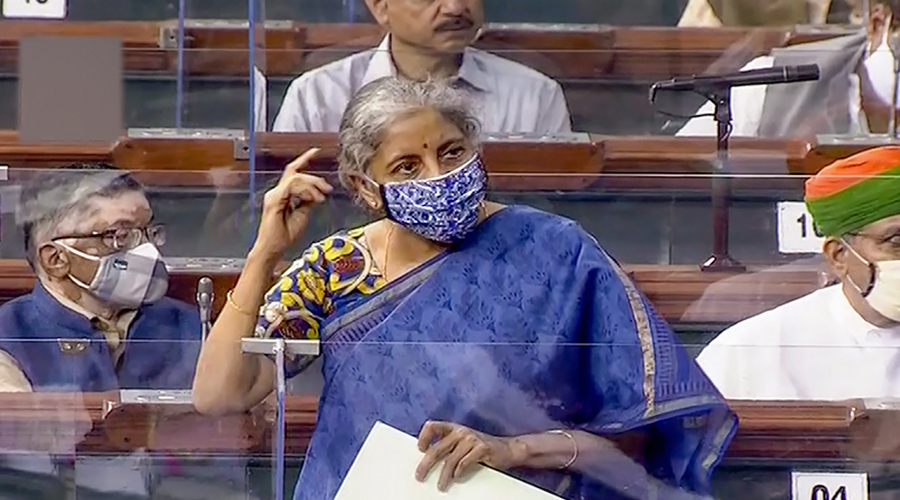

The amendment in the Bill, which was passed by the Lok Sabha on Tuesday, says that the fair value of a slump sale transaction will be deemed to be the full value of the consideration received by the seller of the asset.

Moreover, if the capital asset is goodwill, its value will be treated as nil if the taxpayer had not acquired it through a purchase from a previous owner.

A slump sale of an asset involves a lump sum payment for an undertaking without assigning individual values to assets and liabilities that are being transferred.

Businesses resort to a slump sale when an entire undertaking is being sold and it is either too difficult or extremely cumbersome to fix individual values to all the assets that are being sold.

The Income Tax Act provides a special formula under Section 50B of the Income Tax Act to determine the capital gains on the sale which, at present, is the difference between the networth of the undertaking sold and the consideration received for it.

The networth of the undertaking is calculated on the basis of the original cost of the asset and any added costs resulting from any improvements made.

Long-term capital gains tax applies if the asset has been held by the seller for over 36 months.

Otherwise, the seller has to pay a short-term capital gains tax which is higher.

The tax amendment now means that if the “fair value” of an undertaking is higher than the lump sum consideration it receives on a sale, then the higher figure will be taken into consideration while computing the capital gains irrespective of the actual consideration which it received for it.

The new tax treatment formula for slump sale transactions is being seen as a major setback for corporate restructuring at a time companies have been looking to hive off assets to deal with a Covid-induced crisis.

The amendment will take effect from April 1, 2020, and shall accordingly apply to assessment year 2021-22 and subsequent assessment years.

Mehul Beda, partner at Dhruva Advisors LLP, said: “A major surprise is that in respect of sale of business as a going concern for a lump sum consideration, that is a ‘slump sale’, the lump sum consideration will be substituted with the fair market value of the business, for the purpose of computing capital gains. This amendment is likely to impact corporate restructuring and M&A, especially in situations, where a company transfers a particular business to a subsidiary, in anticipation of an investment by a strategic partner or a private equity investor.”

“It will be interesting to see the fine print of the rules once it is prescribed especially if such rules will factor in liabilities, give weightage to actual sales consideration, provide for lump sum value based approach for the entire business and not itemised value being allocated to any outgoing asset,” said Vinita Krishnan, director at Khaitan & Co.

She added: “Certainly parties may need to carefully evaluate the nature of intangibles that they are paying especially given the non-allowability of goodwill depreciation.”

The tax law amendment has been made even as an appeal arising from a tax dispute is pending before the Supreme Court. The Madras high court had recently held that transfer of an undertaking for non-monetary consideration is not a ‘slump sale’, thus not chargeable to tax under the current tax law. The court had relied on an earlier judgment delivered by the Mumbai high court in another case.

The rationale for the above judgments is that if there is no monetary consideration involved in the transaction, then the transaction may be regarded as an ‘exchange’ and not ‘sale’. Accordingly, it would be not possible for the tax department to bring such transactions within the ambit of the definition for a ‘slump sale’.

The Centre believes that in several such transactions, a "sale" is actually disguised as a "transfer" by the parties to the transaction and ought, therefore, to be covered by the existing definition of a slump sale as it exists today.