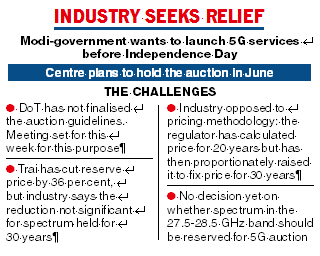

The Centre is expected to finalise the terms of the 5G spectrum auction this week, including the thorny issue of pricing as the industry has strongly resisted the proposals put forward by the regulator.

The Digital Communications Commission, the apex body of the department of telecommunications (DoT), is scheduled to hold a meeting on Tuesday to discuss the response of the Telecom Regulatory Authority of India (Trai) to its queries on the pricing and tenure of spectrum and the rollout obligations.

The DCC will pass on the its recommendations to the Union cabinet as the Centre prepares to hold the auction in June with the launch before August 15.

Telecom players are opposed to Trai’s recommendations on the period of spectrum validity and pricing.

The regulator has fixed the reserve price of spectrum for a period of 20 years and has then proportionately raised the price to arrive at a valuation for 30 years.

According to government rules, Trai makes the recommendations and it is for the DoT to accept or reject them.

Telcos are miffed over the pricing of spectrum although Trai has refused a review.

The industry said Trai has reduced the reserve price compared with its earlier recommendation made in 2018, but that was for a 20-year period . The prices are not much different when fixed for 30 years.

According to the telecom players, a 36 per cent cut in reserve price to Rs 317 per MHz for the 3,300-3,670 MHz band means the operators will pay Rs 31,700 crore against the 2018 price of Rs 49,200 crore for 100MHz.

But to get the spectrum for 30 years at the reduced rate, the payout comes to Rs 47,550 crore, which is not much lower than the earlier price.

The industry has demanded a review as there is enough headroom available to reduce prices by 90 per cent in line with global norms.

Critical issues

The regulator has pushed the ball back in the court of the DoT on whether the crucial millimetre wave frequencies in the 27.5-28.5 GHz band should be auctioned for 5G services.

The DCC’s suggestion to combine the the rollout obligations for the 3300-3670 MHz and 24.25-27.5 GHz bands was rejected by the regulator.

The COAI, a body of telecom operators representing Airtel, Vodafone Idea and Reliance Jio said “despite the government’s decision to allocate 5G spectrum for a period of 30 years, the Trai has decided to recommend reserve prices for 20 years and applied 1.5 times multiple to the price if spectrum is to be taken for 30 years.”

“If one were to look at the pan-India price of 3.5 GHz spectrum, we are back to square one with effectively no change and will nullify the relief provided by the union cabinet in the year 2021.”

The industry has demanded a review as there is enough headroom available to reduce prices by 90 per cent in line with global norms.

The regulator has pushed the ball back in the court of the DoT on whether the crucial millimetre wave frequencies in the 27.5-28.5 GHz band should be auctioned for 5G services.

The DCC’s suggestion to combine the the rollout obligations for the 3300-3670 MHz and 24.25-27.5 GHz bands was rejected by the regulator.

It has also disagreed with the DoT’s stance that the valuation of spectrum should be done at shorter intervals or before every auction – even if held annually - to factor in changes in technology or unsold airwaves.

The regulator has recommended a mega auction plan of over Rs 7.5 lakh crore for over 1 lakh megahertz spectrum in case the government allocates the spectrum for a period of 30 years.

In case of 20 years, the total value of the proposed spectrum auction will stand at around Rs 5.07 lakh crore at the reserve price, according to back-of-the-envelope calculations.

With large swathes of spectrum remaining unsold in the last two auctions, Trai recommended to the government to sell airwaves in all existing bands — 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz and new slots of 600 MHz, 3300-3670 MHz and 24.25-28.5 GHz.

It has suggested about 39 per cent lower reserve price for all the bands compared with the prices proposed in the previous recommendations in 2018.