Fears of aggressive rate hikes by the US Federal Reserve threw Asian shares into the red even as fag-end buying dragged India’s Sensex out of the loss territory.

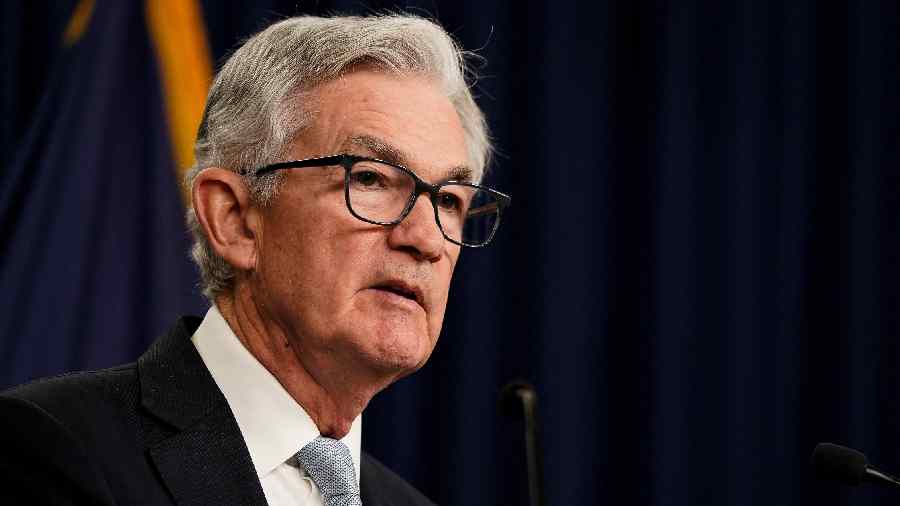

Fed chairman Jerome Powell on Tuesday signalled more rate hikes and a higher terminal rate, scaring Asian investors and driving the greenback higher. However, the late buying saw the Sensex and the Nifty recovering from the Fed blow after floundering for a large part of the session. The benchmark Sensex which had crashed almost 380 points rebounded to close with gains of almost 124 points at 60348.09.

The hawkish comments by Powell also hit the rupee’s movement which fell below the 82 mark and closed 14 paise lower at 82.05. Dollar sales by exporters and softer crude oil prices saw the currency erase some of its early losses.

Powell, in his testimony before the Senate Banking committee on Tuesday, said US inflation was far away from the Fed’s goal of 2 per cent rate in spite of a recent moderation of print — and this requires the interest rates to stay higher for a longer period.

He said the Federal Reserve will likely need to raise interest rates more than expected in response to recent strong data and is prepared to move in larger steps if the “totality” of incoming information suggests tougher measures are needed to control inflation. His remarks has now led to apprehensions that the Fed may even raise borrowing costs by 50 basis points higher than the 25 basis points effected in February.

It is also estimated that the terminal rate — at which the increases will stop — would rise to at least 5.50 per cent against the earlier expectations of 5.1 per cent. With global indices recording losses, the benchmark index opened on a subdued note at 59916.10 and sunk to the day’s low of 59844.82. However, it reversed the losses in the last 30 minutes on short-covering and bargain hunting and closed with gains of 123.63 points.

On the NSE, the broader Nifty ended higher 42.95 points or 0.24 per cent at 17754.40 after falling more than 100 points during intra-day trades to a low of 17602.25. in In Asia while the Hang Seng index closed lower 2.35 per cent, Kospi was down 1.28 per cent, while Nikkei gained 0.48 per cent.

“Domestic equities opened gap down in line with global markets post the hawkish commentary from US Fed Chair Jerome Powell. But value buying at lower levels led the markets reverse its losses and close in the green,” Siddhartha Khemka, head — retail research, Motilal Oswal Financial Services, said. He said the market would remain volatile till the outcome of the next meeting of the US Federal Reserve on March 21 and March 22.

Inverted yield

India’s one-year government debt yield rose above that of the 10-year note on Wednesday, following higher-than-expected cutoffs at a sale of treasury bills that briefly inverted the yield curve for the first time in nearly eight years. The Reserve Bank of India sold 364-day notes at a 7.48 per cent yield, the highest since October 2018. The one-year bond yield, which trades close to the 364- day treasury bill yield, briefly rose to 7.4750 per cent earlier in the day, while the 10-year benchmark 7.26 per cent 2032 bond yield saw a high of 7.4728 per cent.

“Core liquidity is declining, and surplus is falling very sharply, and the process will continue over the next couple of months,” said Pankaj Pathak, fixed income fund manager at Quantum Asset Management. “By April, we may see even core liquidity slipping into deficit and this is a big cause for short-term rates to jump.” Market participants said the lack of bond supply by the central government in March has been a major reason for the yields at the longer end to remain capped.

With inputs from Reuters