US Federal Reserve officials ramped up their battle against the fastest inflation in 40 years on Wednesday, ushering in a third straight supersize rate increase while projecting a more aggressive path ahead for monetary policy, one that would lift interest rates higher and keep them elevated longer.

Central bankers raised their policy interest rate by three-quarters of a percentage point, boosting it to a range of 3 to 3.25 per cent. The federal funds rate was set at near zero as recently as March, and the Fed’s increases since then have made for its fastest policy adjustment since the 1980s.

Even more notably, policymakers predicted on Wednesday that they will raise borrowing costs to 4.4 percent by the end of the year — suggesting that they could make another supersize rate move, followed by a half-point adjustment. Officials estimated that rates will climb to 4.6 per cent by the end of 2023, up from an estimate of 3.8 percent in June, when they last published estimates.

Fed officials expect to begin lowering rates in 2024, but anticipate bringing them down only slowly.

A wave of interest rate decisions from central banks across the world and its impact on economic growth is on investor radar amid a resurgence in geopolitics after Russian President Vladimir Putin announced partial military mobilisation.

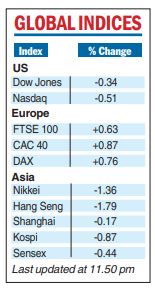

The cautious mood was palpable when benchmark indices snapped a two-day rising trend on Wednesday, with the Sensex falling 262.96 points or 0.44 per cent to settle at 59456.78. This came ahead of a much awaited interest rate decision by the US Fed.

Jerome Powell, the Fed chief, is not the sole figure that is being watched. Some of the other key central banks that will announce their decisions this week include Bank of England (Thursday), Banco Central do Brasil and Bank of Japan, apart from that of Norway and South Africa.

The monetary policy committee (MPC) of the Reserve Bank of India (RBI) will begin its three-day meeting on September 28 where it is expected to raise the policy repo rate at least 35 basis points. The repo rate stands at 5.40 per cent.

Among the central banks, the BoJ is the only one expected to continue with its accommodative monetary policy. There are expectations that the Brazilian central bank will also hold key rates.

Experts said that investors will be watching out for the quantum of the rate hikes and the guidance. They warned that an aggressive rate action accompanied by any hawkish stance could skittle stocks and emerging market currencies.

NYTNS & Our Mumbai Bureau