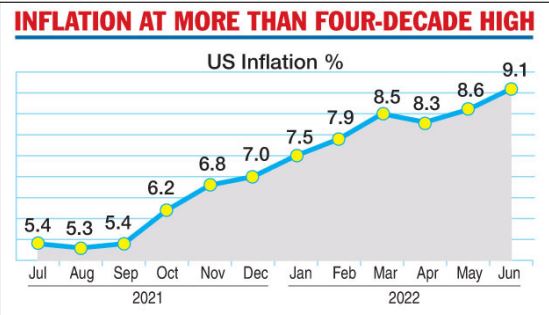

US consumer inflation flared up to 9.1 per cent in June, with the hotter-than-expected data opening up a cornucopia of possibilities — right from a chain of rate hikes by the US central bank and its counterparts in the West to a flight of dollars from India and other emerging markets forcing their central banks to raise rates that will stifle growth. Following the inflation data, traders of futures tied to the US Fed’s policy rate swiftly priced in a higher probability of a 100-basis-point rise at the July 26-27 meeting. Central bankers over the past couple of weeks have already signalled support for a 75 basis point rate increase.

The Bank of Canada took the lead on Wednesday and hiked its policy rate by a massive 100 basis points. Global markets were in a bear grip ahead of the release of the US inflation numbers that had a rub-off on Indian stocks with the Sensex dropping over 750 points intra-day to close in the red. More pain may be in store with US stocks slipping in shaky trading on Wall Street Wednesday after the inflation report turned out to be even worse than expected.

The S&P 500 was 0.3 per cent lower after tumbling as much as 1.6 per cent earlier in the morning. The 9.1 per cent US inflation is the highest since 1981 as soaring gas prices, rising rents and swelling grocery bills made everyday life more expensive for American households. The pickup in prices was broad and faster than expected, spelling trouble for the Federal Reserve. The Fed is no longer waiting for normalcy to return. Central bankers are worried that as inflation remains high and stubborn, consumers and businesses could get used to it.

Many central bankers have been clear that they want to make another 0.75-point increase in July, and that they hope to raise rates into the neighbourhood of 3.5 per cent by the end of the year. They could achieve that by raising rates half a point in September and a quarter point in both November and December. In the bond market, the two-year US Treasury yield rose to 3.09 per cent from 3.05 per cent late Tuesday.

It tends to follow expectations for Fed action, and it got as high as 3.22 per cent immediately after the release of the inflation report. It remains higher than the 10-year yield, which fell to 2.93 per cent from 2.95 per cent. That’s a relatively rare occurrence, and some investors see it as an ominous signal of a potential recession. The inflation data also sent immediate jolts into stock markets across Europe and for gold, with prices for all of them weakening after the report’s release.

(Reuters & NYTNS)

Rupee inches towards 80

The rupee continued to falter at record lows and approach the 80-per-dollar mark as the greenback maintained its bull run and participants awaited the release of key inflation numbers from the US. At the inter-bank forex market, the domestic currency closed at 79.63 to the dollar against the previous close of 79.60, after touching an intra-day low of 79.68. A PTI report said the unit hit 79.81, but this could not be confirmed. The pressure on the domestic currency came as the dollar which measures the greenback’s strength against a basket of six currencies rose to a 20-year high of 108.58 during intra-day trades.