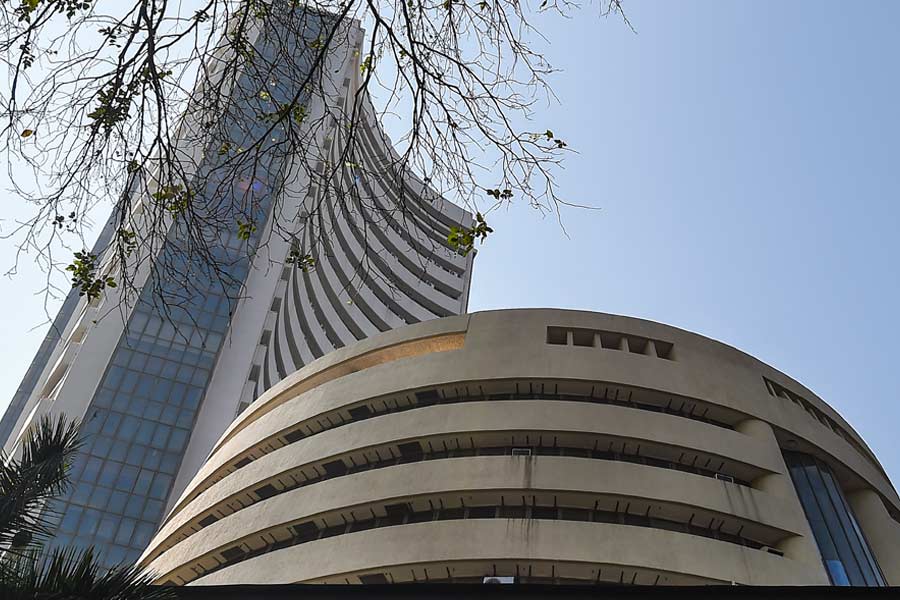

The Sensex gave up initial gains and tanked nearly 794 points to end below the 74000 mark on Friday, while the Fear Gauge or India VIX climbed 8.72 per cent which indicated higher expectations of volatility.

The sell-off saw the Sensex retreating sharply from a 484.04 point gain during the day following positive global cues and a results season that has not delivered any big negative news.

After touching an intra-day high of 75095.18, the benchmark index nosedived 1627.45 points to the day’s low of 73467.73.

Investors pressed the sell button in auto, telecom, banking, oil & gas and realty stocks. The sensex wound the day at 73878.15, a fall of 732.96 points or 0.98 per cent.

On the NSE, the Nifty declined 172.35 points or 0.76 per cent to settle at 22475.85. During the day, the broader index hit a record 22794.70 up 146.5 points or 0.64 per cent.

Market circles are attributing multiple reasons to the sudden bout of selling pressure and the volatility.

Investors are now taking a more cautious stand on the election results, though it is largely felt the NDA would return to power.

Besides, expectations the US Federal Reserve will hold on to its current rates for a longer period is pulling stocks down stocks.

US job growth slowed more than expected in April and the increase in annual wages fell below 4 per cent for the first time in nearly three years, but it is probably too early to expect that the Federal Reserve will start cutting interest rates before September as the labor market remains fairly tight.

Fed chair Jerome Powell in his recent comments did not give a timeline for such a reduction, but only said there would not be an increase in the next policy meet.

These factors reflected in VIX (India Volatility Index), which rose 8.72 per cent to 14.62 after hitting a day’s high of 15.31, an increase of nearly 14 per cent. An higher value is an indication of rising uncertainties or apprehensions.

“Profit-booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside,” Vinod Nair, head of research, Geojit Financial Services, said.

“Though the correction was broad-based, the large-cap stocks were the key underperformer due to the moderation of FII’s exposure to the domestic market,” Nair said.

The broader markets also suffered though to a lesser extent with the BSE smallcap index declining 0.55 per cent and the midcap index falling 0.21 per cent.

Following the wider selling, the market capitalisation of BSE-listed companies sank ₹2.25 lakh crore to ₹406.24 lakh crore.

“The markets failed to capitalise on the firm start despite upbeat US and European cues and crashed on the back of broad-based selling, as investors worried over premium valuations of local stocks offloaded their holdings,” Prashanth Tapse, senior VP (research), Mehta Equities Ltd said.

GIFT P-Notes

Foreign funds registered with India’s markets regulator and with operations at Gujarat’s GIFT City can issue so-called participatory notes, the financial services regulator at GIFT said late on Thursday.

Participatory notes (P-Notes) are issued by funds and banks to overseas investors who wish to invest in stock markets without registering themselves in India.

The International Financial Services Centre Authority (IFSCA), which regulates financial services at GIFT City already allows banks to issue P-Notes.