The Sensex on Friday reclaimed the 61000 level while the Nifty finished above 18000, propelled by positive earnings from corporate India, positive global cues, better-than-expected numbers from Meta and a Rs 12,000-crore share buyback from Wipro amid strong buying from foreign portfolio investors (FPIs).

While the 30-share Sensex spurted 463.06 points to close at 61112.44 after surging 560.08 points during intra-day trades to 61209.46, the Nifty climbed 149.95 points to finish at 18065.

Market circles attributed this positive close to the week to the current earnings season which has not thrown any major negative surprises, barring the scorecard from the top IT services firms which was not unexpected either.

While most of the banks have reported positive earnings, the zing came after Facebook parent Meta reported strong numbers with a profit of $5.7 billion in the first quarter of this calendar year and a revenue of $28.65 billion which was above $27.65 billion expected by analysts according to Refinitiv. It also gave out an optimistic guidance forecasting revenues between $29.5 billion and $32 billion for the second quarter. The development had an impact back home as it led to buying in beaten down IT stocks on hopes of a turnaround in the sector.

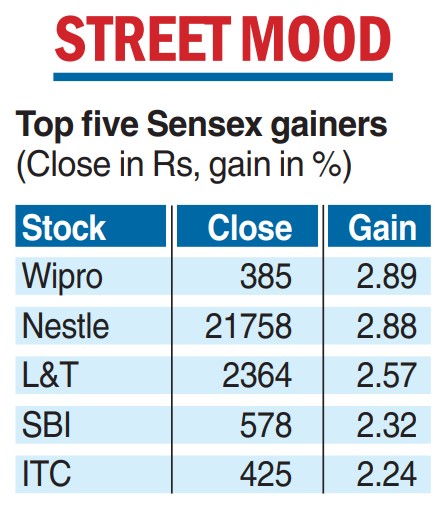

Among IT stocks, Wipro hogged the limelight with its shares rising nearly 3 per cent after the company’s board announced a share buyback of up to Rs 12,000 crore. The stock gained 2.89 per cent to end at Rs 385.15 on the BSE. During the day, it jumped 3.64 per cent to Rs 388. On the NSE, it climbed 2.75 per cent to end at Rs 384.70 each.

It was the biggest gainer among the Sensex pack and the company’s market valuation rose Rs 5,933.21 crore to Rs 2,11,373.41 crore.

On Thursday, Wipro had said that its board has approved a proposal to buy back up to 26,96,62,921 equity shares, being 4.91 per cent of the total paid-up equity share capital of the company for an aggregate amount not exceeding Rs 12,000 crore at a price of Rs 445 per share. The gains on Friday came despite fears of tepid US GDP numbers and the Fed hiking interest rates again by 25 basis points.

“Despite concerns about potentially weaker US GDP numbers and high inflation, the stronger-than-expected earnings reported by Meta propelled IT stocks to the forefront of the Wall Street rally. The trend was reflected in the domestic market, as beaten-down IT stocks helped to lift broader market sentiment. However, with US inflation remaining high, the prospect of another rate hike by the Fed is looming, keeping global markets volatile in the coming days,” said Vinod Nair, head of research at Geojit Financial.

In Asia, Seoul, Japan, Shanghai and Hong Kong ended in the green, though Europe was trading lower. On Thursday, the Dow Jones Industrial Average had soared over 524 points.