The government is set to notify the terms of reference and the constitution of the 16th Finance Commission, which fixes the formula to share taxes between the Centre and states.

The Commission is expected to be formed before the end of this year.

Finance ministry officials said: “The terms of reference and members of the panel would be taken up by the cabinet before the notification is issued.”

The officials said the cabinet could take up the matter by the end of this month or early December.

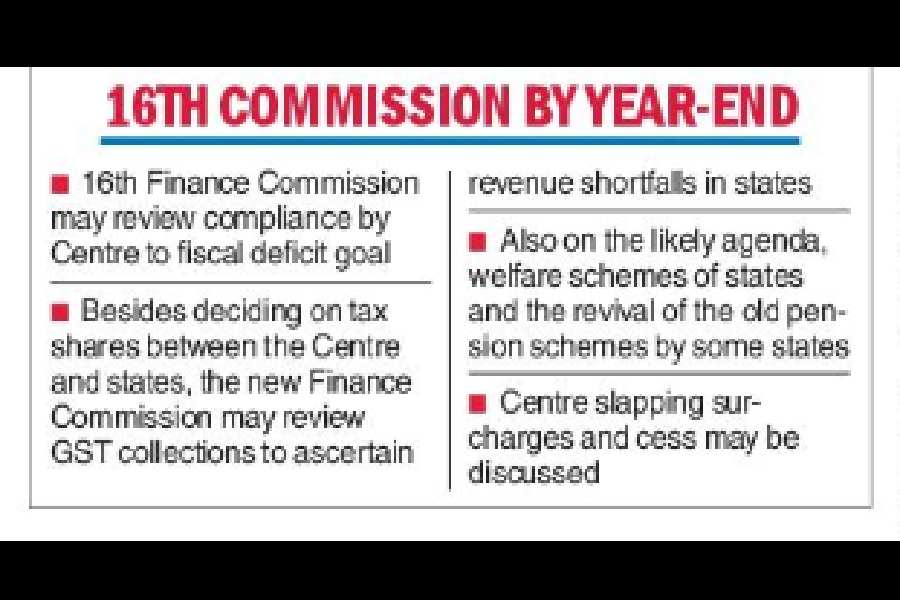

The Commission could be asked to ensure compliance by the Centre with fiscal rules as fiscal consolidation cannot be achieved with just the states adhering to them.

The government's fiscal deficit targets went off the hook with the coronavirus pandemic.

Embarking on a large fiscal stimulus programme, the Union government revised the 2020-21 fiscal deficit to an unprecedented level of over 9.2 per cent of GDP.

The fiscal deficits of 2021-22 and 2022-23 also exceeded projections. The deficit for 2023-24 has been proposed at 5.9 per cent of GDP in the budget.

“Taking the 2023-24 Budget numbers into account, Modi 2.0 will end up with a massive fiscal deficit average of 6.5 per cent of GDP. No Union government since 1991, the year when the economic and fiscal reforms began and fiscal deficits came to be recognised, has run fiscal deficits of such high order,” according to Subhash Chandra Garg, former finance and economic affairs secretary.

The Finance Commission is constituted by the President under Article 280 of the Constitution. Its main functions are prescribed under Article 280.

The Commission recommends the distribution of the divisible pool of taxes between the Centre and the states and the determination of inter se shares. It sets the principles of grants to states.

The Commission also suggests how to increase the Consolidated Fund of a state to supplement the resources of local bodies.

In addition, any other matter can be referred to the Commission in the interest of sound finance.

Revenue share

The Commission will recommend the formula for sharing revenues between the Centre and the states for the five years from fiscal year 2026-27.

Sources said the panel is likely to get the mandate to review the revenue collection under GST. The objective is to ascertain any shortfall to states, with the compensation cess coming to an end.

The cess, levied on luxury, sin and demerit goods, was initially introduced for five years along with the GST from July 1, 2017, to help states meet any shortfall under the new indirect tax regime.

While it technically came to an end in June 2022, the cess is collected to repay the interest and principal on the Rs 2.69 lakh crore the Centre borrowed during the Covid-19 pandemic on behalf of the states.

Since it will possess data on projected revenues over the next few years, the panel will have a much more comprehensive view of GST proceeds and provide appropriate recommendations on cess.

The 15th Finance Commission had little time to consider GST. Though the terms of reference of the 15th Commission did mandate the panel to examine the impact of the GST, it was in the context of compensation to states for a possible loss of revenue over five years.

The Finance Commission examines for division of direct taxes such as income and corporation tax and indirect tax, chiefly the GST, between the Centre and states. Basic customs duty is not part of the divisible pool.

When the 15th Finance Commission came into being in 2017, GST was just a few months old (it was enacted on July 1, 2017).

Among other issues that could be referred to the panel include states resorting to freebies and reverting to the old pension system, which have serious fiscal implications.

Besides, the Centre’s recourse to the levy of cesses and surcharges has become a constant irritant in Centre-state relations.

States' inequality

There is growing income inequality among states, resulting in a feeling among the performing states that they are being discriminated .

While incentivising the performing states, the constraints of backward states cannot be overlooked. Enabling backward states to develop through a separate mechanism of funding can be referred to the Commission.