Steel companies may review their announced expansion plans following the imposition of an export duty from Sunday as the government measure is likely to drag down capacity utilisation, soften margins and worsen credit metrics.

According to one estimate, the duties will impact about 95 per cent of the steel exported out of the country, rendering them uncompetitive in the overseas market. India exported 18.4 million tonnes (mt) in 2021-22, earning foreign exchange of about $5 billion.

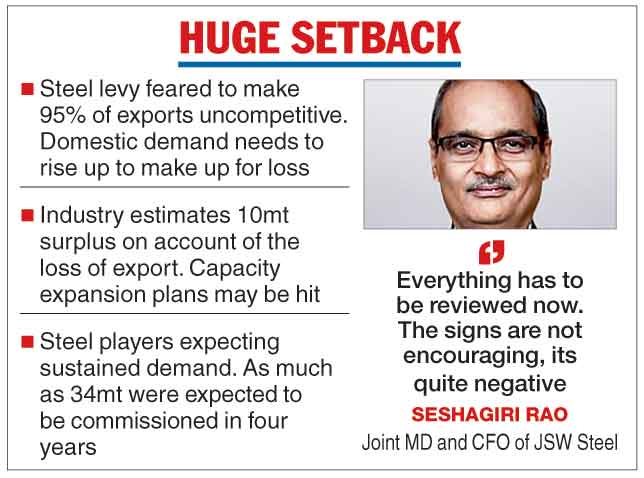

Top steelmakers minced no words. JSW Steel, India’s largest private steelmaker, termed the measure, introduced for the first time in at least 15 years, as ‘‘quite negative’’ for the steel sector.

The companies say the move to reduce import duties on coking coal, pulverised coal or slapping duties on the export of iron ore would be of little help to mitigate the pain caused by the export duty, unless domestic demand spurts exponentially.

India consumed 105mt steel in the last fiscal. Assuming an incremental demand of 7-8 per cent in 2022-23, there will be a surplus of 10mt in the domestic market if export is taken out of the equation due to the 15 per cent duty which will translate to about $120 a tonne impact on average.

The installed capacity is about 149mt and the industry operated at 80 per cent of the capacity, producing about 120mt steel.

“Everyone expected demand would be robust in the export and domestic front and huge expansion plans were announced by all large companies. Everything has to be reviewed now. If export of 18mt is dented and domestic demand is not enough to absorb, then the options are shut down the units, reduce utilisation, review the capex. The signs are not encouraging, its quite negative,” Seshagiri Rao, joint managing director and CFO of JSW Steel, told The Telegraph.

A report by Icra estimated 34mt new capacity to be commissioned by 2026. The companies are also heavily investing in downstream capacities.

Steel makers were also enthused by the void created by Russia and Ukraine in markets such as the US, Europe and West Asia.

A top executive of another top steelmaker held views similar to Rao. “I feel it (duty) will impact the capacity expansion plans of the sector as now we have to depend only on domestic demand and growth,” the executive who did not wish to be named, said.

Rao said iron ore prices have not come down in India despite a fall in the international prices, while coking coal prices went up from $125 a tonne to $560 a tonne. The Centre has slapped 45 per cent duty on pellet, 50 per cent on any grade of iron ore while withdrawing 2.5 per cent duty on import of coking coal.

“If the iron ore prices do not to come down, reduction on coal duty is marginal ($12 a tonne) and domestic demand is not enough to absorb excess demand, the impact would be very large on margin,” Rao explained.

Meanwhile, industry body Ficci has requested the government to give the domestic steel industry three months to clear their orders.

PLI plan flops

The government's ambitious PLI scheme for specialty steel has received just 10 applications, even as the last date to submit interest under the scheme was extended twice, after certain concerns were raised by steel makers, reports PTI.

The last date to submit applications under the PLI Scheme for specialty steel is expected to be extended again for the third time, a senior government official.

Replying to a question on the number of applications received by players under the scheme, he replied 10 applications and 58 registrations have been received so far by players.

When asked about the rationale behind extending the last date again, the official informed “the ministry is yet to come out with the modified scheme.”

Certain steel makers had earlier raised concerns over the scheme, following which the government had begun the process to make certain modifications in the PLI Scheme for Speciality Steel.

In the modified scheme, the government is working on a uniform incentive plan on the production of speciality steel.

More grades, especially those used in the defence sector, will be added to the scheme.

For secondary players, cap on minimum investment and setting up minimum capacity will also be removed, he informed. On July 22 last year, the Union Cabinet chaired by Prime Minister Narendra Modi had approved a Rs 6,322-crore PLI scheme to boost the production of speciality steel in India. The move is expected to attract an additional investment of about Rs 40,000 crore and generate 5.25 lakh job opportunities.