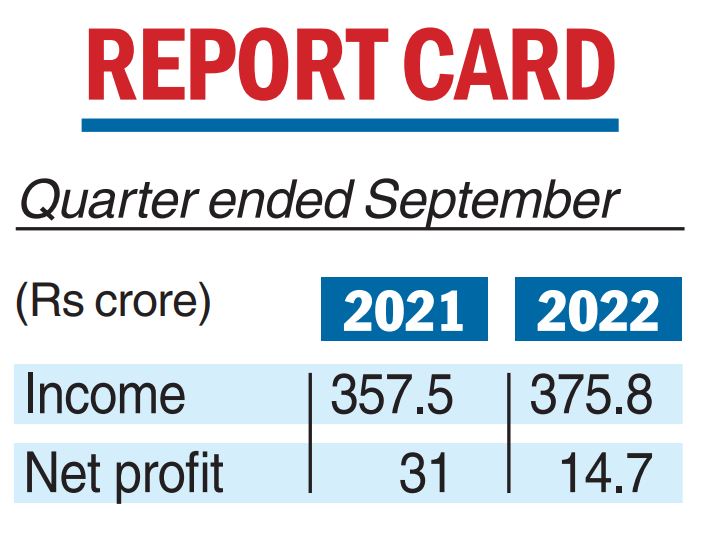

Dry cell battery maker Eveready Industries has reported a 5.11 per cent rise in income from operations in the second quarter of the fiscal at Rs 375.8 crore compared with Rs 357.5 crore in the same period last year.

Profit after tax slumped 52.5 per cent to Rs 14.7 crore in Q2FY23 compared with Rs 31 crore a year ago.

The company suggested the topline growth would be 10 per cent year-on-year if the discontinued operation of home appliances was taken into consideration.

Commenting on the performance of the quarter, Suvamoy Saha, managing director of Eveready, said: “The performance was satisfactory despite sluggish demand in the wake of high inflation and a delayed/deficit monsoon. We are meticulously pursuing a plan to enhance our business mix and towards that we are in the process of revamping our go-to-market in all our key categories.”

In a commentary, the company attributed the steep drop in profit to a non-cash charge linked to a loan and an adjustment to deferred taxes, adding that this will even out for the full year.