The Reserve Bank of India (RBI) on Friday said the country would overcome the losses made during the Covid-19 pandemic only by 2034-35.

In its report on Currency and Finance (RCF), the apex bank said a GDP growth rate of 6.5-8.5 per cent is feasible in the medium term subject to reforms.

The projections come at a time the domestic economy has been confronted by rising inflation which has impacted discretionary spending across several products. In its policy statement earlier this month, the central bank moderated its growth projection from 7.8 per cent made earlier. The real GDP growth for 2022-23 is now forecast at 7.2 per cent.

According to the report, themed “Revive and Reconstruct” and anchored by the RBI’s department of policy and economic research, corporates have coped with the pandemic by deleveraging.

But frail household balance sheets and labour displaced from contract intensive activity have impacted consumption demand and quality of capital.

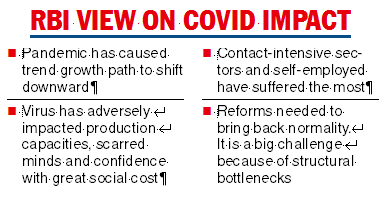

As a result, the trend growth path of India may have shifted downward that urgently requires a comprehensive range of measures to reinvigorate growth.

The report pointed out the pre-Covid trend growth rate for the Indian economy works out to 6.6 per cent. “Taking the actual growth rate of (-) 6.6 per cent for 2020-21, 8.9 per cent for 2021-22 and assuming growth rate of 7.2 per cent for 2022-23 and 7.5 per cent beyond that, India is expected to overcome Covid-19 losses in 2034-35.’’

The RBI added that the virus has caused a deep dent on livelihoods and has “scarred minds, production capacities and confidence with far-reaching economic and social costs’’, and the post pandemic new normal may be very different from the situation that prevailed before the coronavirus raged across the world.

The preponderance of contact-intensive services sector in the domestic economy exacerbated the economic consequences of the large pandemic shock.

The self-employed also bore the brunt of the pandemic. The majority of the self-employed workers are engaged in the informal sector with little job protection and weak social security support, accentuating the adverse economic impact of the pandemic, the RBI noted.

India’s economic rebound also faces difficult challenges from the legacy of deep-rooted structural bottlenecks as well as the scars of the pandemic.

Moreover, the Russia-Ukraine conflict has dampened the momentum of recovery, with its impact transmitting through record high commodity prices, weaker global growth outlook and tighter global financial conditions.

Against this backdrop, India’s medium-term growth outlook depends on policy measures to address structural bottlenecks and harness emerging new growth opportunities.

The report said that though the second advance estimates of national income indicate the economy has surpassed its pre-Covid level in 2021-22, following unprecedented policy support from the monetary and fiscal authorities, India’s recovery from the pandemic,remains fragile and is yet to become broad-based.

Citing the importance of reforms in bringing the domestic economy to a medium term growth rate of 6.5-8.5 per cent, the report said timely rebalancing of monetary and fiscal policies will be the first step in this journey.

Monetary policy has to assign priority to price stability as the nominal anchor for the future growth trajectory, the report said. It also suggested the government debt should be reduced to below 66 per cent of GDP over the next five years.