The Reserve Bank of India (RBI) on Monday further relaxed the rules governing external commercial borrowings (ECBs) by infrastructure firms and certain non-banking finance companies (NBFCs) to help them raise more funds.

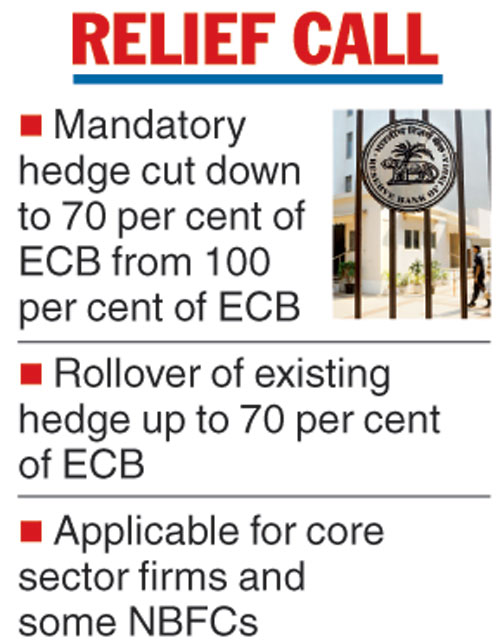

In a circular, the central bank brought down the mandatory hedge cover to 70 per cent from 100 per cent for ECBs raised between three and five years.

This relaxation will be applicable to companies in the infrastructure sector, NBFCs-Infrastructure Finance Companies (NBFC-IFCs), NBFCs-Asset Finance Companies (NBFC-AFCs), holding companies and core investment companies (CICs). It also includes housing finance companies, which are regulated by the National Housing Bank.

The RBI added that the latest relief has been brought in in consultation with the Union government.

“On a further review of the extant provisions, it has been decided, in consultation with the government of India, to reduce the mandatory hedge coverage from 100 per cent to 70 per cent for ECBs raised under Track I of the ECB framework by eligible borrowers… for a maturity period between three and five years.

“Further, it is also clarified that ECBs falling within the aforesaid scope but raised prior to the date of this circular will be required to mandatorily roll-over their existing hedge only to the extent of 70 per cent of outstanding ECB exposure,’’ the notification said.

Under the current ECB framework, the list of entities eligible to raise such borrowings is put under three tracks.

The latest move comes at a time the government feels the RBI should take more measures to provide liquidity to NBFCs. The RBI’s central board is set to meet again on December 14, where the issue of liquidity shortage is likely to be discussed.

More than a fortnight ago, the RBI had relaxed the mandatory hedging requirement for infrastructure loans of less than 10 years. It then reduced the average maturity requirement from 10 years to 5 years for exemption from the mandatory hedging provision.

The regulator had then said that ECBs with a minimum average maturity period of three years to five years in the infrastructure space will have to meet 100 per cent mandatory hedging requirement. This has now been relaxed.

Similarly, earlier this month, the RBI allowed banks to offer partial credit enhancement on bonds issued by some of the NBFCs. A credit enhancement is a method through which a bond issuer improves its creditworthiness following a guarantee from a third party. As a result, investors are assured that their obligation will be honoured, at least partially.

The Telegraph