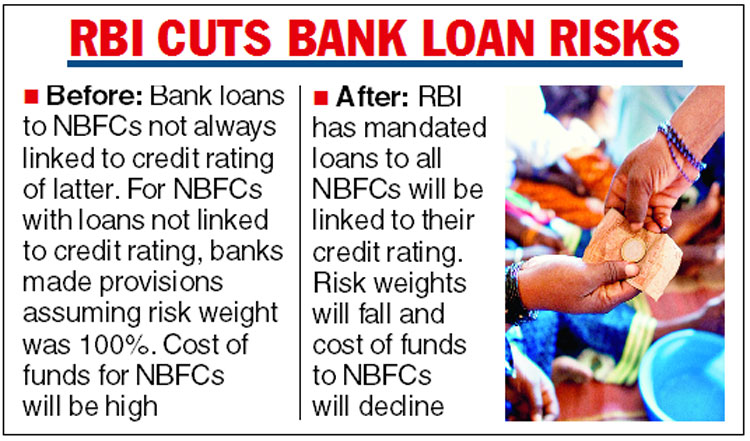

The RBI relaxation on bank loans to non-banking finance companies (NBFCs) could result in lower costs for some of them as the risk weight of the loans will fall to as low as 20 per cent from 100 per cent.

On Thursday, the central bank announced the exposures of banks to all NBFCs, excluding core investment companies (CICs), would be risk-weighted according to their ratings.

The apex bank had clarified that the risk weights on bank loans to companies will be valid for NBFCs, as well.

Speaking to researchers and analysts at a post policy conference call, RBI deputy governor N. S. Vishwanathan said under the Basel guidelines followed by the domestic banks, there is a risk weight of 20 per cent for AAA-rated corporates and 30 per cent for AA-rated corporates.

For a company with a lower rating, the weight stands at 50 per cent. The same system will apply for the NBFCs, as well.

At present, the exposures of banks to certain categories of NBFCs such as housing finance companies (HFCs), asset finance firms, infrastructure finance companies (IFCs) and infrastructure development funds are already linked to their credit rating.

A risk weight is the amount of capital that banks have to set aside after giving the loans. As it is based on the risk perception of the particular asset, lenders have to set aside more money for loans with relatively high risks.

The exact amount of capital that banks have to set aside for the weights also depends on their capital adequacy ratio, which now stands at 9 per cent.

Sector stressed

Analysts feel the relaxation could lower the funding costs for certain NBFCs. This should come as a relief as the sector has been witnessing higher borrowing costs after the IL&FS crisis.

According to a note from Edelweiss Securities, the RBI step will largely benefit “loan companies” as the risk weightage falls to 20-50 per cent from 100 per cent.

“This will not only improve credit flow to loan companies (bringing them on a par with AFCs, HFCs, IFCs), but will also lower their borrowing cost, particularly for AA and below rated entities. This, along with a 25-basis-point repo rate cut and overall dovish stance (from calibrated tightening to neutral) paving way for further 50 basis points rate cut in 2019, will ease funding cost pressure on NBFCs,” it added.

Bajaj Finance, Manappuram, Muthoot Finance, Muthoot Capital and Shriram City Union are some of the loan companies, the brokerage said the benefit of the revision will be more for those entities rated below AA.

Source: The Telegraph