Benchmark indices extended their winning run for the eighth consecutive trading session and ended at all-time highs on dovish comments made by Fed chair Jerome Powell.

The Sensex gained 184.54 points or 0.29 per cent to finish at 63284.19, another record closing high after rising 483.42 points or 0.76 per cent during intra-day trades to 63583.07. At the NSE, the Nifty advanced 54.15 points to end at 18812.50, also its new closing high.

Powell on Wednesday said the fight against inflation was far from over but the Fed could go for smaller rate increases from this month as the impact of earlier big rate hikes has not transmitted throughout the US economy.

"Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting,’’ Powell said in a speech delivered at Brookings Institution.

This led to the Dow Jones Industrial Average zooming over 700 points while the S&P 500 gauge shot up more than 3 per cent on Wednesday. The positive sentiment was felt in Asia on Thursday where markets in Seoul, Tokyo, Shanghai and Hong Kong ended higher. Bourses in Europe were trading mostly in the green.

The domestic mood remained upbeat when the seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) stood at 55.7 in November, up from 55.3 in October, signalling the strongest improvement in operating conditions in three months.

Analysts cautioned that equities were showing some fatigue, and with valuations in some pockets remaining expensive, stocks could consolidate at the current levels.

Some analysts said the bull run was far from over and the Nifty could hit 19000 shortly. They said Sensex could touch 70000 by December 2023 amid a resilient Indian economy. In the near-term, the trend will be dictated by the monetary policy committee (MPC) meeting next week and the Gujarat election results.

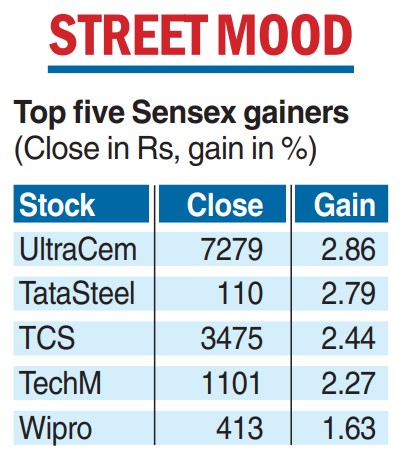

“The Nifty after moving up four per cent in last eight sessions can witness some consolidation around 19000. Expect momentum to continue in global sectors such as IT and metals. Real estate, cement and building material stocks are expected to do well on the back of housing demand,’’ Siddhartha Khemka, head — retail research, Motilal Oswal Financial Services said.

Strong buzz in factory activity

New Delhi: Manufacturing activities touched a threemonth high in November as new orders and exports expanded boosted by demand resilience and substantial easing of cost pressure, according to a monthly survey.

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index stood at 55.7 in November, up from 55.3 in October. A print above 50 means expansion while a score below 50 indicates contraction.

“It was business as usual for goods producers, who lifted production volumes to the greatest extent. New orders and exports expanded markedly,” Pollyanna De Lima, economics associate director at S&P Global Market Intelligence, said.

OUR BUREAU