Benchmark indices on Thursday closed at record highs and the rupee rallied 19 paise against the dollar as risk-on sentiment received a global boost after the minutes of the US Federal Reserve’s (Fed) last meeting showed that the pace of rate hikes may be slowing down.

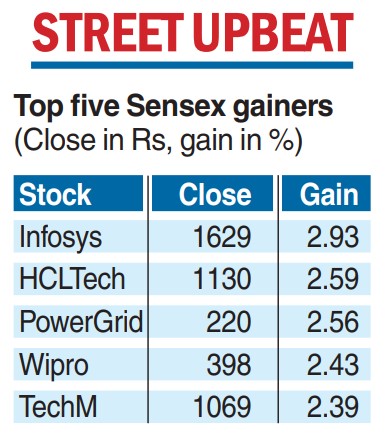

The 30-share Sensex zoomed 901.75 points, or 1.46 per cent, to hit a life-time high of 62272.68 after which it gave up some of the gains to settle 762.10 points, or 1.24 per cent, higher at 62272.68, which was also a record.

The broader Nifty of the NSE jumped 216.85 points, or 1.19 per cent, to end at a lifetime high of 18484.10.

Investors became upbeat after the Fed minutes released on Wednesday showed it could soon slow down the pace of rate increase.

“A substantial majority of participants judged that a slowing in the pace of increase would be appropriate. A slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability,’’ the minutes read.

Markets now expect the US Fed to raise rates by 50 basis points (bps) instead of 75bps at its next policy meeting in December.

The development led to the dollar coming under pressure and the dollar Index was trading below the 106 mark at 105.82, while yields on the 10- year US treasury eased to 3.68 per cent.

It also resulted in US stocks closing in the positive territory with the Nasdaq ending higher by nearly a per cent.

Falling crude oil prices also contributed to the market buoyancy: the benchmark Brent crude is ruling at $84.41 per barrel against the previous close of $85.41 per barrel.

“Two triggers assisted the Sensex rally to record highs. In the mother market US, the market construct turned favourable with rising equities, declining bond yields and falling dollar. Two, macro developments in India show steady rise in credit growth and capex indicating strong economic recovery. Along with this, a sharp correction in crude is a big positive,’’ V.K. Vijayakumar, chief investment strategist at Geojit Financial Services, said.

At the forex markets, the rupee opened 13 paise stronger at 81.72 on the FOMC minutes and weakness in the dollar index and Brent crude. It later ended at 81.63 to the greenback, a gain of 19 paise against the previous close of 81.85.

“The rupee has been an under-performer over the last fortnight, primarily on account of demand for dollar from oil marketing companies and some bids from foreign portfolio investors (FPIs),” Anindya Banerjee, VP — currency derivatives & interest rate derivatives at Kotak Securities, said.

“However, strong risk sentiments can continue to push the dollar lower, towards 81.25/30 levels. We expect an overall range of 81.25 and 81.85 on spot.’’